Analysis of survey data from the last five years shows that around 2.4 million workers in the ten most populous states in the country lose approximately $8 billion annually due to minimum wage and overtime payment violations (to mention some violations of labor law). Consequently, if your employer owes you money, do not be discouraged; the law protects you, and there are legal actions to demand what corresponds to you.

There have always been these inconveniences at work, but if you need help to solve this situation, here you will find a guide with the steps to follow.

Even though each jurisdiction has its regulations, it is necessary to mention that some general laws will protect you no matter where you are.

Unpaid wages, commissions, and settlements

There are several situations in which your employer may owe you money, for example:

- They have not paid your wages or have not paid you the correct amount.

- Your employer has made unauthorized deductions.

- You quit or resign, and they have not paid your settlement.

- Or you were promised a bonus, and you did not receive it.

Many times (not always), if you have not received a payment, it may be due to an error on behalf of your employer; so the first thing we recommend you to do is taking the situation with your employer and solve it directly. However, it is recommendable that you write everything that is going on (either with an email or a letter) and keep a copy for yourself, in case you need it as evidence. Also, if you are part of a union, you may ask them for advice.

If you do not get a response about why your employer owes you money, and you already tried any other courtesy way unsuccessfully, then you can start a legal procedure.

Legal procedures and how to execute them

There are two main procedures at your disposal to demand your payment:

File a claim with the U.S Department of Labor

The U.S Department of Labor has numerous divisions in charge of handling all labor-related matters across the nation. If your employer owes you money, the Wage and Hour Division (WHD) is the government institution to contact; one of its functions is to assist all the claims related to payment of wages and other employment benefits.

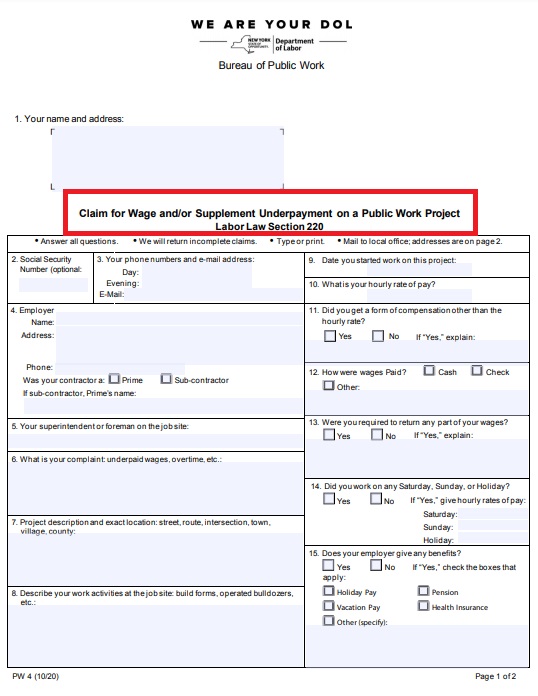

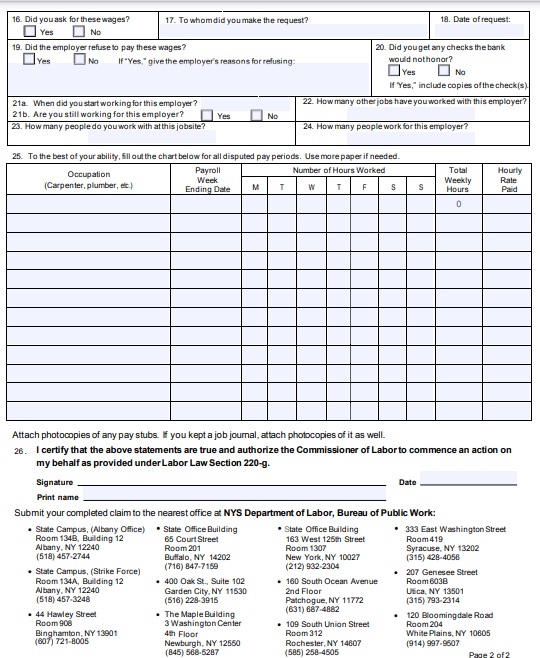

Filing a claim is quite simple; you must present all the necessary documentation to prove this situation (such as pay stubs, number of hours worked, etc.) and specify the following information:

- Your name, address, and contact number.

- Name, address, and telephone number of the company where you work (or worked).

- Name of the manager, supervisor, and/or owner of the company.

- Your working conditions, including what type of work you do, your working hours, how much and when you are paid, etc.

For your convenience, here is an example of a claim that was done for public workers from New York who did not receive their full payment.

Nevertheless, if you need more information about this document, you may ask the Wage and Hour Division by calling 1-866-487-9243, go to the nearest office, or visit their official website.

File a lawsuit in the labor courts

On the other hand, you can also file a private lawsuit to the labor courts, but you will need a lawyer to do it; however, before starting this legal procedure, there are certain things that you must consider.

Suppose your employer is a small business and has not paid you. In that case, you should ask yourself if they will be able to pay what they owe you after a successful (but expensive) lawsuit to demand back payment, an amount for liquidated damages, plus court costs and attorney’s fees. It could also happen that even if it is not a small business, there are situations that could deprive your employer of paying you more than they owe you, and you will end up losing more money.

Something very important that you should know is that you will not be able to file a private lawsuit if you have already filed a claim with the Wage and Hour Division and your employer has paid you back wages under the supervision of the U.S Department of Labor.

Prescription period

In order to file claims, it is imperative to do it within two years of the violation for which you are claiming back wages (in case of general violations) and in some cases 3 years (for an employer’s willful violation).

Consequently, we recommend you not delay contacting the WHD or filing a lawsuit in court for your back pay. Once the stipulated time to file the claim has elapsed, you will not be able to preserve your claim under federal law.