The 501c7 status refers to non-profit organizations, with tax-exemption, characterized by the fact that they do not generate profits. These types of organizations are fraternities, country clubs, hobby clubs, among others.

In these groups, all the fundings do not generate taxes (thanks to the 501c7 benefit), but they must be used exclusively for non-profit projects and activities.

So, if you are interested in knowing more about an organization with this status or starting one, we prepared this article with all the essential information you need to know and its requirements.

What is 501c7?

It is a type of organization that does not receive funds from the public, and they are usually recreational.

The most common groups include fraternities or brotherhoods, university student associations, country clubs, sports clubs, religious clubs, gastronomy clubs, libraries, gardening clubs, among others.

However, requesting income taxes only discourages the people in these clubs, that is the reason why the Internal Revenue Service (IRS) classifies them as tax-exempt and promotes their creation, as we see highlighted on their website: https://www.irs.gov/charities-non-profits/other-non-profits/social-clubs.

These types of organizations have to be self-sufficient, and their activities must be focused on recreational purposes.

Their main sustain are members’ subscription fees; however, they cannot use these contributions as business expense deductions, otherwise the club would lose its status.

Although the application to qualify for the 501c7 status is available online: (Form 1024), organizations do not need to request it to the IRS.

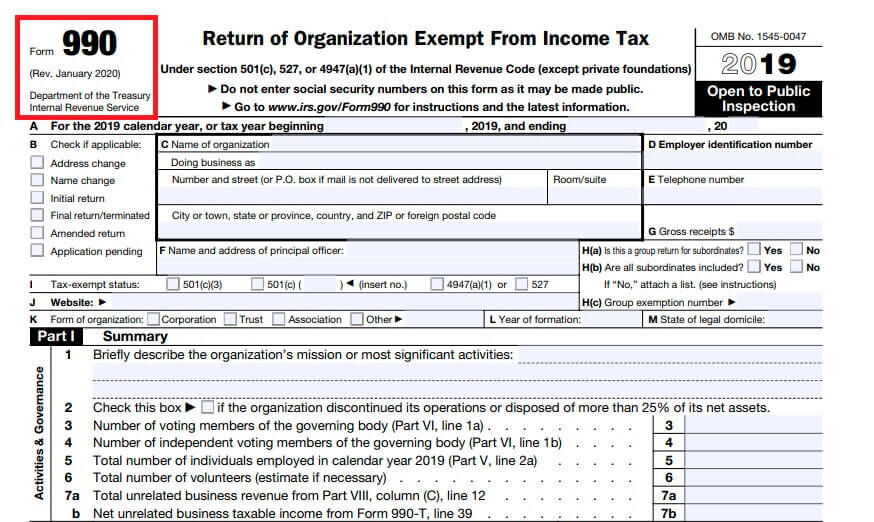

The only mandatory documentation is the annual returns, in which you must identify yourself as a social club. To do so, you will need to fill Form 990, so we recommend you to read this article to get more information: What is form 990 and who can file 990ez?

501c7 Requirements

The IRS establishes specific requirements to receive the 501c7 tax-exempt status, such as:

Membership

The organization strictly needs to be a club made-up of memberships of individuals; also, these members must share similar recreational goals and interests.

The IRS is very strict with the parameters of membership, to verify that everyone participates in the club.

This requirement is so essential that those organizations that do not allow or do not promote contact between their members are not eligible for tax-exemption.

Also, the addition of members is what distinguishes social and recreational organizations from commercial organizations.

Purpose

The club cannot be created for commercial purposes. It must be focused on pleasure, social, and recreational activities, declared in its constitutive document.

Income

Incomes or profits cannot be for the benefit of one or more private shareholders or members.

A club that realizes activities that pursue an individual profit or a private benefit for its members, such as sports competitions, are not eligible to be exempt.

This type of organization must obtain 65 percent of its income from its membership fees; the remaining 35 percent can depend on investments or other sources, and no more than 15 percent can come from the club services at recreational events.

Discrimination

The organization expressly prohibits discrimination against people in terms of sexual orientation, race, or religion. Discrimination policies against anyone can lead to the loss of the 501c7 status.

The only clubs exempted from this rule are the ones that practice a particular religion, but only if they want to promote and teach it.

Expiration date

Another requirement that the IRS takes into account is the need for memberships to be limited; this means that they all should have an expiration date and the possibility to renew them.

It is clear that the 501c7 status requirements are complex and can be a trap for a club administrator or other members if they do not comply with the requirements of the law.

Fully understanding and following these rules will keep your club with tax-exempt benefits, save you troubles with the IRS, and allow you to take advantage of great opportunities.

If you intend to create such an organization, we recommend you to contact a tax attorney who is familiar with the topic, to ensure that you will be able to achieve 501c7 status with no problems.