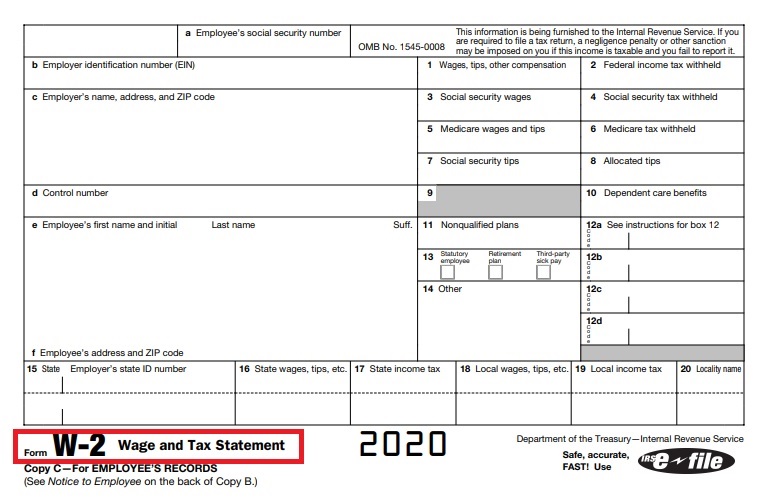

One of the requirements imposed by the Internal Revenue Service (IRS)on employers is to fill out the W-2 form. In this document, they have to report information related to their employee’s wages, and the state and federal taxes that are deducted from their paychecks.

This information is essential to prepare tax returns that will then be sent to the IRS.

Employers must send the form before January 31st of the following year of the tax return; however, if you need to obtain a copy of this document at any other time, in this article, we will explain how to get it.

Request copies to your employer

The first thing to consider is, who can give us a copy of the W-2?

One option is to contact the payroll or human resources department of the company where you currently work, or where you previously worked. This is the most common way to obtain the form of the current or previous year.

In this link, you can see how the W-2 looks like: www.irs.gov/pub/irs-pdf/fw2.pdf.

Most companies with large numbers of employees generally hire a payroll provider to organize their administrative duties, especially the payment of wages and the tax declaration.

You must verify if the company where you work (or worked) used this service; if that is your case, you must go to that company to get your copies.

When you make the request, we also recommend that you include your Social Security number or employee number, specify the year of the Form W-2 you need, and ask how long it will take to get the copy.

Request copies to the IRS

In some cases, people cannot contact their employer or the payroll provider to obtain their W-2 copy; if this happens to you, do not worry, there is another option: Make a request to the Internal Revenue Service (IRS).

This is done through a document called Form 4506: www.irs.gov/pub/irs-pdf/f4506.pdf.

Logically, this option will only be available if you previously filed your annual taxes, and if in those taxes you attached a copy of your Form W-2, if you did not do it, there is no way the IRS can have a copy.

If you are unsure about what you did, or require any additional information, you can always contact the IRS at 1-800-908-0046.

Request copies to the Social Security Administration

In addition to the IRS, there is another institution that can give you the copy you are looking for: the Social Security Administration; this entity has administered copies of W-2 forms since 1978.

They will provide your copies for free as long as the reason for your request is closely related to Social Security or similar purposes; otherwise, the applicant must pay a fee of $81.

If the copy is for a not related purpose, you must make a request that includes a check or money order to pay the fee (payable to the Social Security Administration). And it should also include:

The address to which the request should be directed is:

In general, employees often need copies of the W-2 because they have an audit, because they are paying their taxes, or they are applying for another benefit.

Given the importance of this form, we recommend that you fully organize your returns; keep a strict control that allows you to know your expenses for federal, state, or any other taxes.