When the time to pay taxes comes, we use to think of it as a cumbersome process due to all the calculations and forms that we must carefully fill out and sign. And perhaps it may not be so easy to complete this process but we should not underestimate ourselves and think that it is extremely difficult. In this article, we provide you with a guide to successfully complete your Arizona Form 140.

The Internal Revenue Service (IRS) and the state departments offer the necessary guidelines to make this process easier for all taxpayers, allowing them to comply with tax obligations on time without paying penalties.

If you have any questions about when or how to fill the Arizona Form 140, continue reading because we will explain the official guidelines of the Arizona Department of Revenue.

When do I need to use the Arizona Form 140?

To find out if you must fill out the Arizona Form 140, check the following criteria:

- If you and your spouse (legally married) wish to file a joint return and have lived in Arizona for the full taxable year.

- If you belong to the U.S Armed Forces and have received active duty pay.

- If your taxable income is $ 50,000 or more.

- If you are a member of the National Guard or if you are a reservist and have received active duty pays.

- If you are claiming estimated payments.

- If you itemize deductions.

- If you are calculating and making adjustments to your income.

- If you claim tax credits other than the property tax credit, excise tax increase, or the family income tax credit.

Arizona Form 140 filing dates

Tax returns for the 2020 calendar year must be filed between January 1st, 2021, and April 15th, 2021. If you are a tax year filer, the deadline is the 15th of the fourth month following the close of the tax year.

Extension

In case you cannot complete the form on the due date (from January 1th, 2021 through April 15th, 2020) you can request an extension. You have two ways to do it:

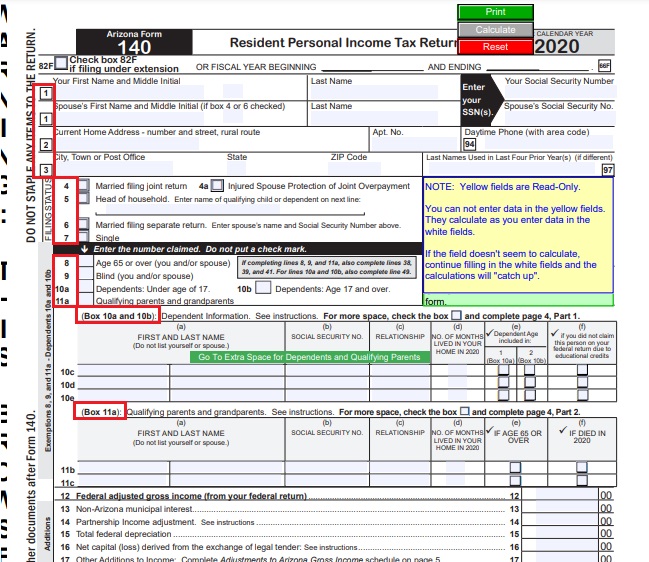

- Arizona form 204: In addition to completing the Arizona Form 140, to request the extension you must file the Arizona Form 204 by April 15th, 2021. All you have to do is to check box 82F on the left corner of your return.

- Federal Form 4868: It is the same procedure as the previous one but with a federal form. You just have to fill it out on the due date and send it along with the Arizona Form 1040 (you must be aware of checking the box 82F).

It is important to remember that the extension does not extend the time of payment of your tax obligations; it is only a request to complete and submit your tax returns. Once the request is submitted (if you are not notified that there was an error) you will automatically be granted a 6-month extension.

How to file the Arizona Form 1040

This form is composed of 5 pages; you should not fill them all if you are not qualified for it. Below we briefly explain how you should file your tax return.

Page 1 -2

On the first page, you will find a series of “lines” that you must complete with the required information.

- In Lines 1 to 3, you must write your personal data and those of your spouse. Names, surnames, addresses, and Social Security Numbers.

- Lines 4 to 7, correspond to information related to your marital status. You must check the box if you and your spouse are filing a joint return together, if you are single or if you are married but are completing the separate form for your spouse.

- Now, the next thing you need to fill out is the exemptions. In Lines 8 to 11a, you will see a box with the exemptions (dependent, blind spouse, 65 years old or over…). In the box, you must write the number of exemptions that you’re claiming, if you mark an “x” it might be rejected. In the following boxes (10c – 11c) you may fill in the details of the exemptions that you listed above. For example, if you have a dependent under age 17 enter “1” in box 10a and then fill in their personal data on line 10c.

If you need more space, on page 4 of the form you can write the additional information, just check the box indicated.

The next step is to calculate your federal adjusted gross income and for this, we recommend that before completing the Arizona Form 140, you may file a 2020 Federal Form to know the amount of your federal adjusted gross income. Even if you are not required to submit the Federal Form, you should do it to calculate the amount. You shall write this information on Lines 12 to 18.

In Lines 19 to 35, you must put the information related to your net profits and losses. Read carefully and complete what corresponds to you according to your specific case.

The exemptions from Lines 36 to 42 should be filled out only if you qualify and comply with what is established in the form.

In Lines 43 to 63, you may calculate what is related to your taxes in the strict sense, since in the previous lines you complete information about your incomes, losses, and economic obligations.

In Lines 64 to 75(3), you can make donations to funds identified in Arizona Form 140, such as Child Abuse Prevention, Domestic Violence Service, Veteran’s Donations Funds, or you can even make donations to political parties (Republican, Democratic, Libertarian). Once you write the amount of your donation you will not be able to change it with an amended form.

Lines 76 to 79 include estimated payment penalties.

To finish this part, in Lines 79 and 80 you must write the calculation of your refund or amount owned, depending on your case.

The next step is that both you and your spouse must sign the Arizona Form 140. When doing this, you must be very careful and check that the data is written correctly.

Page 3

You should only fill out this page if you have an increased standard deduction for charitable contributions. In the form, you will be able to read the instructions to write this information.

Page 4

This page is where you can write additional information about your dependents in case you don’t have enough space on page 1.

Page 5

You only need to complete the schedule on page 5 if you need to make adjustments to your Arizona tax return.

Filing the Arizona Form 140 online

Currently (April 2021), the Arizona Department of Revenue offices are closed to the public. However, both the IRS and the tax authorities of the state of Arizona have partnered with the “Free File Alliance,” a nonprofit coalition of industry-leading tax software companies that offers the service of completing tax returns through the internet and free of charge.

You can access these pages that we list below and follow the instructions to complete this process online.