When the time to file our income taxes comes, depending on the state where we live, we would have to complete a form to inform the Department of Revenue about our income. Each state has its own forms and regulations on how to calculate income and tax rates depending on how much money you make. Although state regulations may be similar, in this article we will talk about the Arkansas State Tax Form.

If you lived in Arkansas for a few months or are a full-year resident, you must complete the state tax form and pay what corresponds to you in addition to meeting your obligation of doing the same with the federal income tax.

In this article, you can find information on how to file it properly.

How do I know if I have to file a Tax Form?

Before knowing how to file this form, in the first place, it is important to know if you are actually are obliged to do so. Either if you live in Arkansas, if you are an advisor for this type of paperwork, or simply everything related to Arkansas state tax form catches your attention.

In Arkansas there are three types of circumstances that could tell you if you should complete these types of forms:

- Full-year resident: if you live permanently in Arkansas or during the fiscal year you have been in Arkansas for more than 6 months, for tax purposes, you are considered an Arkansas resident.

- Part-year resident: A part-year resident is a person who during the fiscal year moved within the state or moved out of its limits but during their stay received some type of income from an Arkansas resident source or employer.

- Non-resident: it may seem strange for you that a non-resident must file an Arkansas state tax form. But according to state law, if a person does not live in Arkansas (they don’t make it their domicile) but receives income from an Arkansas source, they must file and pay state income taxes.

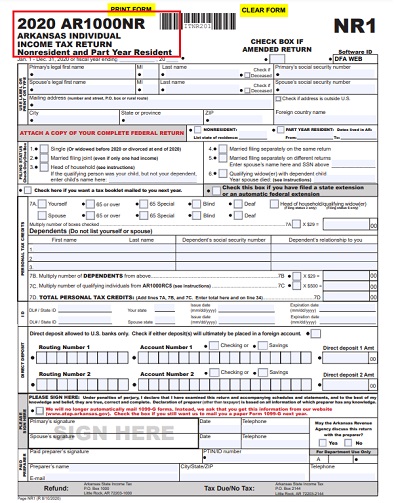

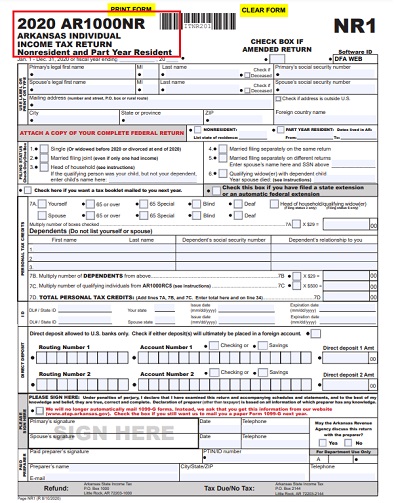

If you meet any of these circumstances, you must file an Arkansas state tax form. Non-residents and part-year residents must file Form AR1000NR.

On the other hand, if you are a full-year resident, your form must be AR1000F.

Regarding full-year residents, in addition to living in Arkansas during the fiscal year, they must meet the income requirements.

READ MORE: How to apply for unemployment benefits in Arkansas?

Steps to file your Arkansas State Tax Form

Step 1

In the first lines, you must write your basic data. Enter your full name, address, ZIP code, state, city, and Social Security Number. In the case you’re filing AR1000NR, you must mark if you are a non-resident or a part-year resident and detail the dates you lived in Arkansas.

Step 2

In the following lines, you must write the information related to your filling status. If you are single, married, or widowed. For married couples where only one spouse lives in Arkansas, they cannot file a joint return. They must file the corresponding form and mark option 5 “married filing separately on different returns.”

Step 3

Then, it’s time for personal tax credits. As a taxpayer, you’re entitled to claim one personal tax credit and so is your spouse. However, if you are blind, deaf, or by January 1, 2021, you are 65 or older, you can claim additional personal tax credits.

In this same section, you must also write the name of your dependents (if you have).

On line 7c, write the number of your dependents who have developmental disabilities (if applicable). Then, do the math calculations indicated on the form and enter the amount in the spaces. If you have dependents with developmental disabilities, you must attach your Form AR1000RC5.

Step 4

Next, you must write your routing and account numbers if you want to receive direct deposits from your refunds on your checking or saving accounts. It’s important for you to know that direct deposits won’t be made into accounts outside the United States. If there is a problem with the deposit in your account, the refunds will be issued as paper checks.

Step 5

Now it is time for income calculations. If you’re filling the AR1000F form, you may see two columns, “A” and “B”, they must be used only if you and your spouse are filing jointly on the same return. If your filing status is different from it, you must only use column A.

If you’re filing AR1000NR instead, you may see 3 columns “A”, “B” for jointly file, and “C”. Since this form is used by non-residents and part-year residents, on column C, you must write only your Arkansas income (those from Arkansas sources).

Instructions are very detailed, so you must read carefully and subtract or add when it’s embedded.

- On line 23, you must write the result of adding line 8 to line 22, this would be your total income.

- On line 24, enter the amount of your claimed adjustment if you’re claiming it. You can calculate your adjustments using Form AR1000ADJ. Then, you must enter your adjusted gross income on line 25.

Now, you may calculate your taxes. Before checking the boxes, you may read this PDF and verify which income rate you are. In the case of standard and itemized deductions, you must use “Regular tax table”.

Step 6

From line 34 to 38 of your Arkansas state tax form, you must write your personal tax credits, those being whether personal, child care, or other credits. For child care, the credit allowed is 20% of the amount on your federal return.

On line 36, you may write your amounts for Credit for Adoption Expenses, State Political Contribution Credit, Phenylketonuria Disorder Credit, Business Incentive Tax Credit, or other state tax credit. If you’re claiming these credits, your must attach your Form AR1000TC.

Then, lines 38A to 38D are only for non-residents and part-year residents. If you’re a full-year resident leave those lines empty.

Step 7

The next thing you must write is the information related to your payments. From lines 39 to 46, read the information required carefully and write the results of your calculations on the spaces provided.

If you’ve lost your W-2, you may contact your employer and ask for a copy. You can also contact The Social Security Administration by calling (800) 772-1213 if you cannot get it from your employer. Your last option if you don’t have your W-2 is to attach your Arkansas state tax form to 4858 Federal Form; this form is used as a substitute for form W-2.

Lastly, from lines 47 to 52C, you may only enter information if you’re claiming refunds or paying taxes due.

Due Dates

Just like federal returns, the due date for Arkansas state tax form is April 15th (if it is a weekend or holiday, the due date will be the next business day).

If you need more time, you can try these:

- If you’ve already filed a federal extension (Form 4868), you may have an extension for your Arkansas state tax form automatically without doing anything else. You just have to mark the box indicating you filed a federal extension.

- File AR1055-IT Form. On the opposite, if you don’t file federal returns, you can request a state tax extension by filling this one. This form works similarly to federal extension. The director will grant you a 6 month extension time to file your Arkansas state tax form.