If you are a resident of Alabama and the amount of your annual income as a worker qualifies under certain conditions, you have the responsibility of filing individual income taxes and make the corresponding payment each year.

Besides the federal ones, these taxes contribute to finance public safety, building and maintenance of infrastructure, health insurance, and public education such as schools and colleges.

Although it seems like a difficult process, in this article, we will show you the main things you need to know.

When do I qualify to file a tax return?

The Alabama Department of Revenue (ADOR) collects taxes to individuals according to their residence, marital, and filing status, as well as their annual gross income.

For your convenience, in the next chart you will see the minimum amount of gross income that you must earn, in each case, to qualify for an individual income tax return:

On the other hand, if you wish more information on how to select your filing status for the tax return, click here.

Tax forms

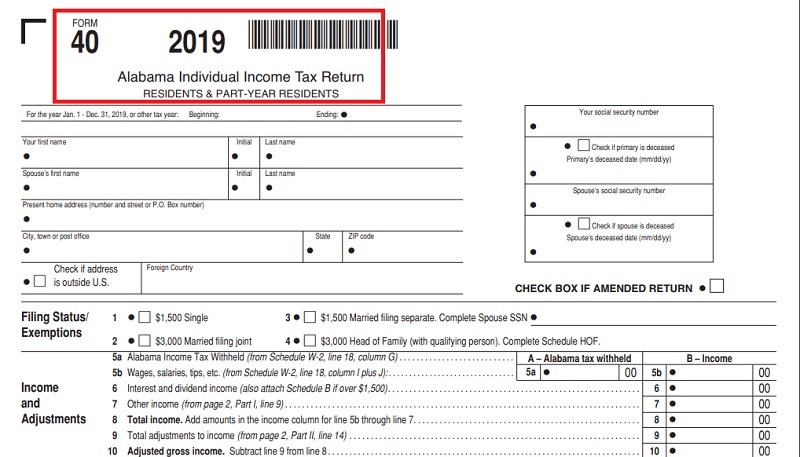

To be able to pay your taxes, you must first file an individual income tax return. There are different forms depending on your legal status; the main ones are:

- 40A(Full-Year Residents Only).

- 40 (Residents and Part-Year Residents).

- 40NR (Nonresidents).

Additionally, in this guide, you will see more information about how to select the right form.

Remember that all these documents correspond to the year that is being declared. In this case, these are the forms of 2019 to be submitted in 2020; the ones for 2020 are not available on their website yet. However, you can get the estimation forms to calculate the approximate amount you will have to pay.

Alabama also has an Electronic Filing Program so you can file your tax return from your home using your personal computer. Determine if this option is available to you by checking with your Authorized IRS E-file Provider.

Payment options

Traditional payments

You can pay in cash, check, or money order. In this case, must submit it loose in the envelope, along with the 40V Form. Also, all checks must be payable to the Alabama Department of Revenue.

Take a look at this list to determine where to mail your payment according to your form type.

Electronic payments

- ACH Debit:

You can pay by ACH Debit, entering in My Alabama Taxes website; follow the instructions, complete the registration, and select the option that suits you best according to your needs.

To use this service, you will need your bank routing number and checking account number. No additional fee is charged for this service.

- Online payment:

The Alabama Interactive platform allows you to make online payment of your tax extensions.

- Go to: www.alabamainteractive.org/taxextension.

- Select “Single Filers”.

- Read carefully all the information presented to you and complete it with your data. For this process, you will need the Form 40V.

- Credit card payments:

There are two options to pay with a credit card:

- You can go with the Official Payments Corporation, they accept American Express, Visa Discover/Novus, or MasterCard. Visit their website or call 1-800-272-9829 using the Alabama Jurisdiction Code (1100).

- You also can use the Value Payment Systems with your Visa MasterCard, Discover/Novus, or their BillMeLater program. Check it out at: https://paystatetax.com/al.

In both cases, there is a convenience fee paid to the providers for using these services. The amount is determined by the provider and might vary.

Due dates in Alabama

The filing and payment dates for individual income taxes in Alabama are generally due to April 15th, unless that day turns out a holiday or weekend, in which case the return will be due the next business day.

If you cannot file your return by the due date, the Alabama Department of Revenue will automatically grant you a 6 months extension (until October 15th). This means that you will not get a penalty for filing after the due date.

Unless you’re out of the country, no extension will be given for more than 6 months.

Tax rates

Alabama is one of the states with lower tax rates, they are determined by your filing status in relation with your taxable incomes:

For single persons, heads of families, and married persons filing separate returns:

- 2% First $500 of taxable income.

- 4% Next $2,500 of taxable income.

- 5% All taxable income over $3,000.

For married persons filing a joint return:

- 2% First $1,000 of taxable income.

- 4% Next $5,000 of taxable income.

- 5% All taxable income over $6,000.