Currently, one of the primary resources of the states in the U.S. is the collection of taxes, and Alaska is not the exception. However, not all types of taxes are collected there; for example, income tax is not required.

Knowing this information is necessary, but it is a duty of all citizens since many government projects are sustained from taxes.

If you are a resident of Alaska and wonder what taxes you are obligated to pay, keep reading this article in which we explain the commercial and personal activities that are taxed and how to pay them.

Personal income tax

As we mentioned before, annual income is not taxed in Alaska. So, if you live there, you do not have to pay any type of tax on your personal income, even if it is earned or unearned, independently from the amount.

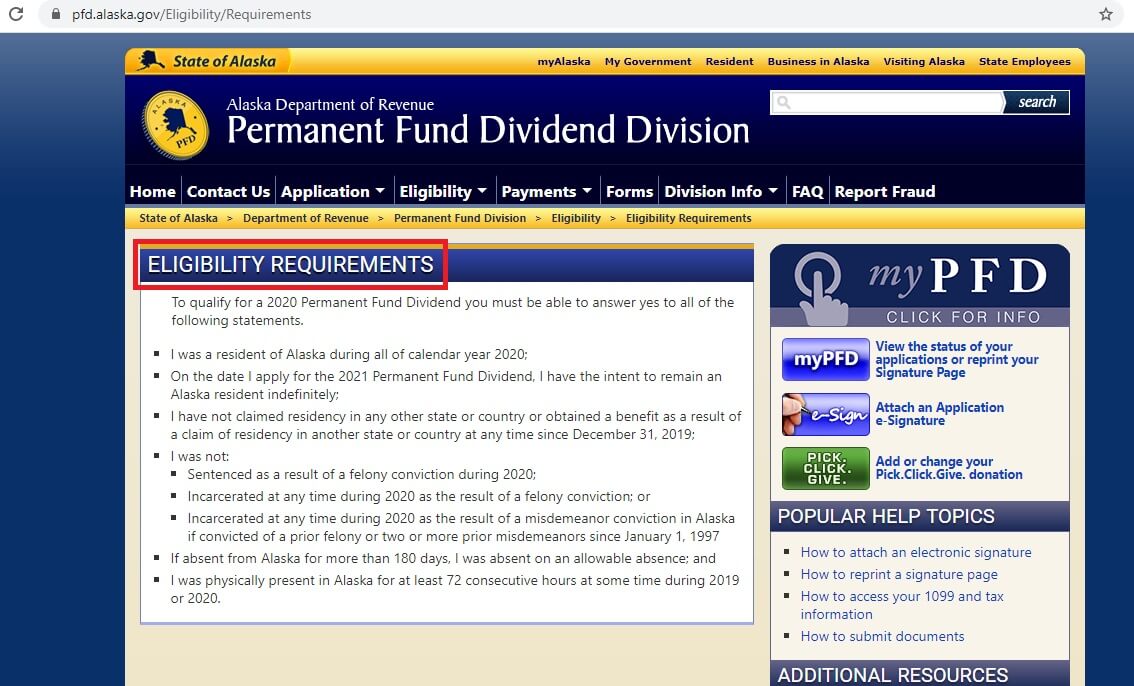

Unlike the rest of the country, Alaska’s state government gives all of its inhabitants an annual payment in the form of dividends through the Permanent Fund Dividend program, also known as PFD. This program’s objective is to distribute among the ones who meet the eligibility requirements part of the state’s income from minerals and the investment of royalties.

In case you want to apply or verify if you are a possible candidate, these are the requirements:

If you fulfill these criteria, you can apply here. Fill the blanks with the required information, accept the User Agreement and click ‘Start Registration.’

Another curious fact is that, along with Alaska, there are other states that do not require the payment of income tax, such as Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Sales taxes

Like the income tax, Alaska does not impose a state sales tax; however, some municipalities and districts may have the authorization to collect it, and the range goes from 1% to 7%.

In the case of municipalities, you can check the local taxes and fees of the Municipality of Anchorage here.

Property taxes

In many states, one of the largest sources of income for local governments comes from property taxes. In fact, an economic study carried out in 2014 revealed that municipalities generate around $1.7 billion annually, and approximately $1.4 billion of that amount comes only from this type of tax.

On the other hand, although Alaska residents are exempt from paying income tax, property tax is levied in some municipalities and districts. By clicking on this link, you can check the local governments’ official pages to obtain more information about it and the contact information of those in charge of assisting taxpayers.

➡ READ ALSO: How to get Alaska retirement benefits

Other taxes

We already explained the three most important taxes in general: income, sales, and property; however, Alaska has other types of taxes that you must know:

- Raw fish.

- Tobacco.

- Liquor.

- Transfer of fuel.

- Gambling.

- Unemployment.

- Vehicle rental; which can vary depending on whether it is a passenger vehicle (10%) or a recreational vehicle (3%).

- Among others.

All of them apply to both the citizens and business owners. For the convenience of the latter, the U.S. Small Business Administration has a district office in Alaska to provide assistance on these matters; you can contact them by calling this number: 907-271-4022 / 800-755-7034.

Payment options

The Alaska State Government enables taxpayers the option to pay online with no additional cost for licenses and permits for the following tax programs:

- Partnership.

- Tire Fee.

- Alcoholic Beverages Tax.

- Motor Fuel Tax.

- Tobacco Tax.

All you have to do is enter on the Alaska Department of Revenue – Tax Division’s official website, create a new account or log in if you already have one, and fill in your information. Then, you will be able to complete your tax return safely and quickly.

We recommend you read the instruction guide to do it properly; click here to download it.

For any other tax payment, you must do it through the Electronic Federal Tax Payment System (EFTPS). If you do not have an account, click ‘Enroll’; if you have one, click ‘Make a payment.’

Contact information

On the other hand, if you need to solve any problem related to your taxes or if you have doubts, you may contact the Tax Division of the Alaska Department of Revenue here.