There is a variety of situations that might require you to transfer ownership of a car to a family member and you wonder how to do it without getting in a long and complicated process.

The reasons to transfer ownership of a car to a family member may vary from: A teenager getting a driver’s license for the first time and receives a car as a gift, or there was a recent death in the family or maybe the car is being donated.

In any case, there is a way of transferring a car title to family and not having to pay sales taxes on the vehicle if the transfer is being made to an eligible family member, such as:

- Children

- spouses

- Parents

- Grandparents

- Grandchildren

- Siblings

- And even partners

The process will be similar to a regular process minus the taxes part.

Corroborate the title to transfer ownership of a car

Before starting to go throughout the steps on transferring the vehicle, make sure that you own it. This means you that you possess in full the title of the car.

If you are not the sole owner is because you have either one of these two cases:

Pay all liens

Maybe you still have liens, so in order to start the process of transfer the ownership; you must pay all the debts on the vehicle. After the car loan is paid in full, the lien holder has to be removed from the ownership title; this procedure is generally made by the lien holder.

Following, the lien release it has to be signed and mailed to your address, then you should go to the Department of Motor Vehicles, as soon as you can, to present the car lien release along with the vehicle title transfer application and pay the fee. The documents can also be sent by mail, but the process will take longer.

If the lend was made from a bank or through a financial institution, you will have to find the original documentation to find out who and where to contact to pay off the credit.

Co-ownership cases

In case that you use to co-own the car, the approbation signature of the other proprietary will be needed. But, if the person died, you will need the assistant of the local Probate Court and also, the executor of the estate of the deceased owner.

If the deceased co-owner was a spouse, the death certificate will be sufficient to transfer the ownership of the car.

When the car is an inheritance, an affidavit along the Registry of the Motor Vehicle has to file, this is sufficient to take possession, furthermore, the process will depend on the State law.

In either case, once the process is completed, the property title is signed to the sole owner; it has to be consigned at the Department of Motor Vehicles (DMV) to complete the title transfer and take in the regard that there is going to be a charge of a transfer fee.

Fill the transfer section on the reverse on the title

On the back of the ownership title, there is a form that must be completed.

The requirements are:

- Driver’s license information

- Odometer information of the vehicle at the time of the transfer

- Signature

- The person receiving the car must fill the buyer’s portion of the form and fill the space of the “Sale price”, must write “Gift”.

Take in mind that the writing must be clear and legible; it shouldn’t have erasures or cross-outs. In case of errors in the writing (even simple errors) will require that you get a hold of a new duplicate of the title certificate in order to start over.

Verify requirements with the state DMV

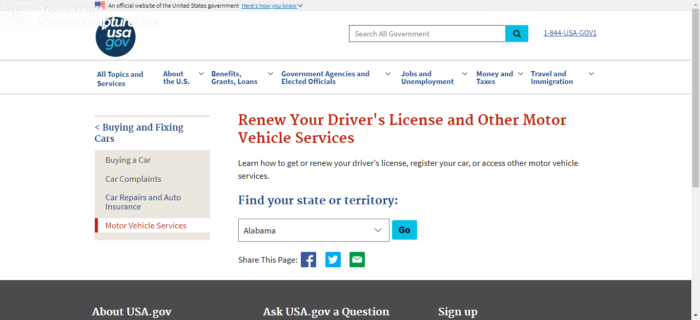

Generally, there is no tax payment when transferring the ownership of a car to a family member, this is freely allowed. Nonetheless, each state has its own laws; therefore you should check the ones for the state that you are currently living in.

For example, some states will ask you for proof of the family relationship in order to the transfer is tax-free.

Make sure the beneficiary is insured

The person that will receive the vehicle has to be insured in order to be able to take ownership of the car.

Even though this does not concern the person giving the car, but to the person receiving it, at the time of the transfer you must present the proof of insurance. The insurance company often issues a card to the insurance, that card has to be presented.

This insurance is also necessary for the receiving person to be able to use the car.

Check if the car needs to be inspected for the transfer

In some states the law requires that the vehicle is inspected in order to transfer the ownership to a family member, therefore you will have to check the requirements for that inspection. Usually, the procedure is to take the car to a licensed check-up station and go throughout a safety examination and emissions tests.

Not always an inspection is needed because of that it is important to verify first with the state DMV.

Complete the transfer of the ownership

Submit the papers to the Registry of Motor Vehicles (RMV)

Following, the family member that you are transferring the vehicle too has to deliver the completed title with both signatures to the Registry RMV and pay the fee if requested (it will depend on the state).

Receive the new title

It is expected that the new documents on the vehicle are delivered on the address submitted at the RMV. On arrival, the new owner must check if the information on the title incorrect, this is very important because if there is a mistake, even if it is a minor one, it could cause problems, so the mistake has to be corrected by the RMV, for that you will have to fill out an application form.