Have you ever thought that you would like someone else to take care of all your tax procedures? Whether because you do not have time for your work or the care of your family, or simply because you do not understand the calculations and tax regulations. The Arizona Form 285 can be your solution; complete this form and designate another person to carry out some tax procedures on your behalf.

Each year, numerous Arizona residents complete this form to avoid paying penalties for failing to meet their tax liabilities on time. By appointing someone else to handle their tax obligations, they have the peace of mind that they will meet their filing and paying tax obligations.

If you find this interesting, keep reading and find out how to file and submit this form.

What Is Arizona Form 285 Used For?

Just as we mentioned above, Arizona’s 285 Form, has the main objective of authorizing someone else to go to the Department of Revenue and complete the paperwork for you.

Through this form, it is possible to share confidential information on their tax status (such as income tax issues) with the designated person. Besides, the taxpayer may authorize their Appointee to carry out other procedures on his or her behalf, this means, represent and sign applications or claims on their representation.

For instance, you as a taxpayer may authorize an attorney to sign an exemption from the statute of limitations, or request a formal hearing on your behalf.

Arizona Form 285 Users

In principle, all Arizona resident taxpayers can complete this form and designate their Appointee but for your convenience, we will list the taxpayers that can do it:

- Individuals who file joint returns.

- Individuals.

- Partnerships.

- Corporations.

- Sole proprietorships.

- Limited liability companies (LLC)

- Groups of combined or consolidated corporations.

- Governmental agencies.

- Trusts.

- Estates.

- Any other association, group, or organization.

In the case of trustees, since they act as taxpayers and not as representatives, they should not file the Arizona Form 285 if they wish to authorize a person to represent the entity. Instead, they must present a signed power of attorney identifying the person to act on behalf of the taxpayer or entity.

How To File Arizona Form 285?

This form has 9 sections that you must complete with information related to your personal data, also of your Appointee, and the actions that you want your representative to do on your behalf.

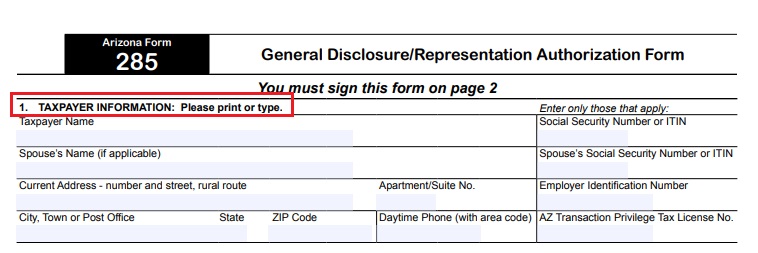

Section 1

In the first lines of section 1 of your form, you must write your full name as well as your spouse’s name if you are married, address (if you have a foreign address, you must write it in this order: city, state, and country), and phone number with area code.

Besides, if you are signing this form for income tax purposes, write your Social Security Number (SSN), your Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN).

On the “AZ Transaction Privilege Tax License” line, write the number of your license if you only have one. If you have more than one, you need to attach another sheet and identify your licenses’ numbers and locations (the licenses covered by your Arizona Form 285).

Section 2

For tax purposes representation, you may appoint more than one individual (businesses or corporations cannot be an Appointee). On lines of section 2, you may write the same information as section 1 but with your Appointee’s information. Full name, address (if your Appointee has a foreign one, write the city, state, and country without abbreviating the country name).

In addition to this data, you need to enter the identification number of your Appointee. It may be a Certified Public Accountant (CPA), SSN, ITIN, or any other identification number issued by the government (such as Passport number or driver’s license number).

When your Appointee contacts the Department of revenue they must provide that number to prove she or he is effectively authorized to act on your behalf. If you appoint more than one individual, each one must have their own ID number.

Section 3

In this part of your Arizona Form 285, you must specify what actions your Appointee is authorized to do on your behalf. Remember that this form can be used for various types of taxes if you wish.

On the form, you may see the options in which you want to authorize your Appointee. Select the ones of your preference and if you want to authorize on liquor, bingo, or tobacco taxes, check the box “other” and write the tax you want. You also have to enter the tax periods and your type of ownership.

Section 4 and Section 5

You only have to write on these sections if:

- You want to do an additional authorization besides the ones you did in Section 3. In Section 4 boxes, you may read the additional circumstances in which you want to authorize your Appointee.

- You want to grant your Appointee a power of attorney. This means you’re authorizing an individual to perform all the acts listed in Section 4 (from 4a to 4h). If you want to make a limitation to this authorization, write it on the line of Section 5. If you want to grant this power of attorney, skip Section 4.

Section 6

This section is for you to specify if you want to revoke prior authorizations made with the Arizona Department of Revenue. If you only want to revoke some of your previous authorizations, then write on the line the ones you want to remain in effect.

Section 7

This section is destined for corporations with controlled subsidiaries. Write in this section only if you are a principal corporate officer of a parent corporation and you want to include or exclude individuals from the disclosure authorization.

This section should not be used to appoint individuals. Instead, you may use a separate sheet. Select the option of your preference and write the names with the additional information.

Section 8 and Section 9

Finally, it’s time for you and your Appointee to sign your Arizona Form 285. Read carefully the statements and write the required information. Your Appointee must sign your form if you granted a power of attorney or have authorized them to perform the acts listed in Section 4.

Consequently, the authorized individual must read carefully from lines 9a to 9d and select the option that fits the specific situation according to their profession.