In addition to federal taxes, each year we must also pay state and municipal taxes if applicable. One of the taxes that almost all of us have to pay is property taxes and the amounts can vary depending on the state and the assessed value of the property.

The Arizona property taxes are one of the lowest in the US; while in the rest of the country the average is 1.07%, in Arizona the effective tax rate is 0.62%.

If you want to know when and how you should pay your Arizona property taxes, you have found the right article.

Arizona Property Taxes Due Dates

In Arizona, there are tax policies a little different from those in the other states. Mainly, the effective rates are a little lower than the nationwide average, and also the dates on which they must be paid are also different, since, unlike other states, the Arizona property taxes are levied twice a year.

The payment of these taxes is divided into two semi-annual installments:

- The first is from January to June whose expiration date is October 1st of that same year.

- The second is from July to December and must be paid until March 1st of the following year.

The Arizona Department of Revenue mails bills to taxpayers in September. These mails contain two coupons for each semester of the fiscal year and remind that although the second installment is due in March of the following year, that payment corresponds to your taxes from the previous year. Because of this, you have surely heard that the Arizona property taxes are paid in arrears.

For people who have a mortgage on the property, invoices will be sent to the lender since these types of taxes are part of the monthly payments. And also, regarding the apportionment of property taxes, this occurs at the closing of the taxes accumulated but that are not yet due or payable according to the closing date and the amount of the annual tax.

We recommend that you check this table and verify the Arizona tax dates.

What Are The Rates Of Arizona Property Taxes?

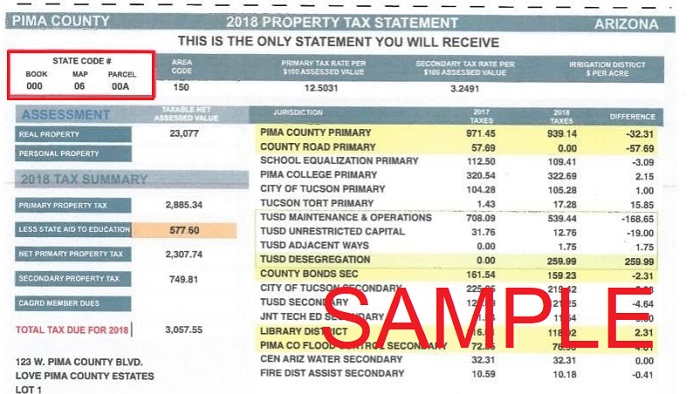

As we mentioned before, the tax rates of Arizona property taxes are one of the lowest in the country and can vary each year as the tax authorities make the calculations based on your financing needs. This occurs because the establishment of tax rates depends on several factors such as the county, city, school district, special districts and also because these rates are divided into two large groups depending on the financing needs of the state.

The money collected from the payment of taxpayers can be used to finance municipalities and school districts called primary tax rates, or to finance special districts and bond issues for the creation of important and highly useful projects for the state, also known as secondary tax rates. However, most taxpayers are levied with the primary tax rates.

One very important thing to know is that in all districts, the total primary tax rate for owner-occupied homes is no more than 1% of the limited value of the property. This occurs when the home is the owner’s main residence and if the total rate exceeds that amount, the tax authorities will reduce the amounts corresponding to the school district and will assume the difference.

On the other hand, if the rate turns out to be less than 1%, homeowners who actually live in their properties may receive a 40% refund of school taxes, which is equivalent to almost $ 600 annually.

List of counties

Due to these regulations explained above, the Arizona property taxes are considered one of the lowest in the country. Next, we will give you an approximate of the effective property tax rates in Arizona, from the highest to the lowest.

- Pima County: 1.01%

- La Paz County: 0.91%

- Yuma County: 0.89%

- Cochise County: 0.83%

- Apache County: 0.81%

- Navajo County: 0.77%

- Gila County: 0.77%

- Santa Cruz County: 0.77%

- Pinal County: 0.76%

- Graham County: 0.66%

- Mohave County: 0.63%

- Maricopa County: 0.61%

- Coconino County: 0.59%

- Yavapai County: 0.58%

READ MORE: Arizona driver’s license • Types and requirements

How Do I Pay Arizona Property Taxes?

Currently, many counties offer online services so that taxpayers can fulfill their tax liability on time and from the comfort of their homes if they have an internet connection.

For example, Pinal County offers payments with credit cards, debit cards, e-checks, and even a mobile tax; you can verify this information and how to use each payment method on this page.

Pima County also has its official page for online payments and even a property search. On this page, write your mailing address, zip code, taxpayer number, assessor account number, and your Pima county property location.

As we mentioned before, almost every county in Arizona allows you to pay your property taxes online, you only need to search for your county page and follow the prompts.