Are you getting your treatment in a hospital or from a professional health care provider?

You may have got Medicare plan A and B for drug coverage in the professional setting, but it cannot cover your drugs cost outside the professional settings. If you have to religiously buy pricy prescription drugs, you must sign up for Medicare plan D.

70% of Americans are signed up in the Medicare part D plan. They cover your prescription drug cost and ensure that your medicines stay affordable, and protect you from paying future high prices for drugs.

The cost you have to pay for this plan depends on the types of prescription drugs you use, their cost, the manufacturers of the drugs, and the source from where you get them.

If you are unsure which Medicare prescription drug plan is best and suitable for you, have a look at the three best Medicare part D providers, each of them with pros and cons.

Medicare plan D eligibility

Before signing up for the Medicare plan D, make sure that you are eligible for the plan. Here is its eligibility criterion:

- 65 years of age or older.

- Must have original Medicare.

- Younger with disability.

- At end-stage renal disease with mandatory dialysis or kidney transplant.

Medicare plan D categories

The Medicare plan D is divided into four categories:

- Tier 1 includes generic prescription drugs.

- Tier 2 includes brand-name or preferred drugs.

- Tier 3 includes brand-name non-preferred prescription drugs.

- Tier 4 includes high-cost prescription drugs.

Top 3 best-rated Medicare part D plans providers

Cigna

It is best in terms of the number of medications covered. Cigna is a top pick for its well-priced and reliable options. With its decent plans, it provides coverage for a variety of requirements.

The Healthy Rewards Program provides various discounts available at 9000 fitness centers, hearing, nutrition, vision programs, chiropractic, massage, and acupuncture services.

The appealing aspect of the plan is the availability of 3000 medications and a network of 63000 pharmacies.

Pros

- Good plan choices (Essential, Secure, Extra).

- Pharmacy network of 63,000.

- 3000 covered medicines.

Cons

- Co-pay charge for Tier 1 drugs.

- Expensive premiums.

➡LEARN MORE: What are Medicare Advantage Plans?

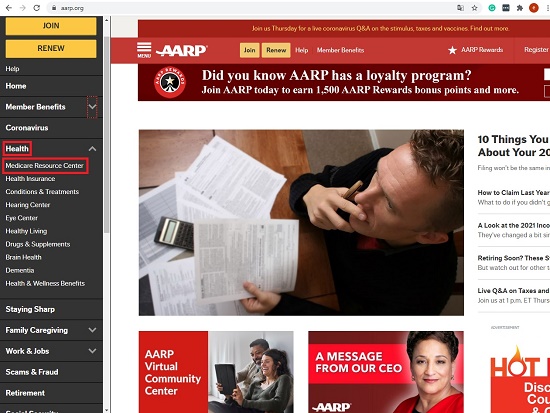

AARP

It is a winner for its comprehensive drug inclusion and the best plan for seniors. The company offers three well-rounded plans with clearly written and understandable information. AARP is a pioneer in insurance for senior people and includes thousands of medications in its plan.

A lot of educational material about general Medicare information, plans, and sign-up questions are available on the website. All plans may not cover some of the medications. So, make sure that you have checked your mediation coverage before choosing any plan.

Pros

- Three plans.

- Easy understanding of information.

- Valuable educational material on the website.

- Tier 1 free co-pay.

Cons

- Higher deductibles.

- Cannot divide payments into multiple paying methods.

Humana

It has an untroubled website and the simplest process of comparing the three plans and have thousands of medications. The website automatically detects your location (if the location is on) and offers plans available in that area.

If you get your prescriptions at Walmart, you also get the benefit of the cost-sharing option. Walmart and Sam’s Club pharmacies are included on the network that you have access to. The company’s top-tier plan covers more than 1500 generic drugs.

Humana’s most basic plan, the Walmart value Rx plan, is among the least expensive plans.

Pros

- Simple to compare plans.

- Tier 1 free co-pay.

- Offers plans with affordable and comparable costs and coverage.

- $0 deductible on a lot of generic drugs.

Cons

- Requires the Humana Pharmacy app.

- High deductible on special drugs.