When a citizen of Texas loses his job, he can apply to obtain Unemployment Benefits from the Texas Workforce Commission (TWC) if he meets the requirements for this purpose. These are contributions from the state to individuals who are not currently working for reasons beyond them.

States that provide these benefits have similar formats regarding payment amounts, qualification procedures, among other characteristics.

However, in this article, we will show you how these benefits work and what are the requirements to get them in Texas.

Required information

Before you start your application, be sure to have the following:

- Your name, address, telephone number, and email.

- Social Security number.

- Proof of US citizenship or legal authorization to work in the US.

- Data of your last employer (business name, address, phone number, supervisor’s name and email, and salary).

- First and last dates (month, day and year) you worked for your previous employer.

- Data of your dependents (if any) (names, Social Security numbers, and birth date).

- Your current or regular occupation and skills.

- If you are a newly discharged veteran, member 4 copy of Form DD-214.

Eligibility criteria

The Texas Workforce Commission (TWC) is the department that manages unemployment benefits and determines eligibility on a case-by-case basis. Applicants must meet the following three requirements:

Previous wages

It is necessary to have received several salary payments before becoming unemployed; this means that you must have had a stable employment relation.

The state of Texas will study your work history during a “base period” of one year; this period ranges the first 4 quarters of the last five calendar quarters preceding your claim’s date.

To have a payable claim, you must meet all of the following requirements:

- You have wages in more than one of the four base period calendar quarters.

- Your total base period wages are at least 37 times your weekly benefit amount.

For your convenience, here is an example of how to calculate your base period.

Cause of unemployment

The cause of your unemployment cannot be, in any way, your own decision. In this case, you will not be eligible to get the benefits. Below, we will show some unemployment reasons that are considered valid:

- Dismissal due to the necessary reduction of personnel in the company you worked. Companies often fire employees when they can not cover their payrolls; if this is the case, you may qualify.

- Dismissal due to the inability to perform the skills assigned to do your work. You can not qualify if your dismissal is related to aggressive or disrespectful conduct. The state of Texas considers “misconduct” as a risk to the safety of other employees, and therefore, the labor system.

- Justified resignation. However, you must prove that you did not want to resign, but there was no other choice; it can be for reasons like unsafe work conditions, sexual harassment, late payment, etc. If you can justify it, you may be eligible to get the benefits.

Willingness to work again

You must be able to work again at any time, and stay active looking for a new job. These benefits are temporary, so the state expects you to get a job as soon as possible. If you get a job offer, you must accept it if it is suitable for you.

➡ READ ALSO: How to change your name in Texas

Application process

There are two options to apply for unemployment in Texas:

By phone

Call the Tele-Center of TWC: 800-939-6631 to start your application. They will ask you the information we mentioned at the beginning, so be sure to have it already.

Online

This is the fastest way to file for benefits, and it is very simple.

- First, go to: www.twc.texas.gov/jobseekers/unemployment-benefits-services#applyBenefits, and click “Apply for Benefits.”

- Click “Submit an application for unemployment benefits.”

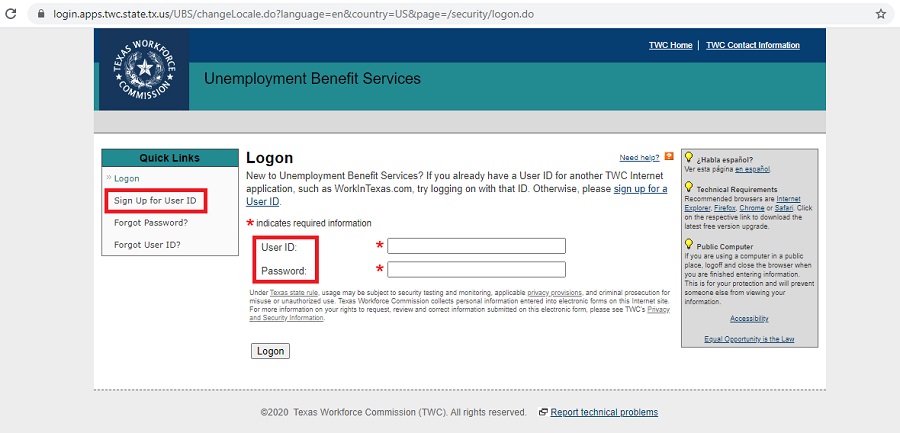

- Enter to your account with your User ID and password. If you already have a User ID for another TWC Internet application, try logging on with that ID. Otherwise, click “Sign Up” on the left sidebar.

- Then, just follow the instructions until you complete your application. We recommend you to use this guide through the process.

Benefit amount

If you qualify for unemployment benefits, your weekly payment will be calculated on your income during the base period. The current minimum amount is $69 per week, and the maximum is $571 per week.

On the other hand, you can receive benefits for a maximum of 52 weeks. In times of very high unemployment, there may be additional weeks of benefits available.