Learning to calculate your paycheck deductions is not something you are obliged to do, since you can hire someone to do it for you or simply wait for the payday so you can find out how much money you have. However, knowing this can be very beneficial when making your budget because you would not need to wait for your payment to arrive to know how much money you will be taking home.

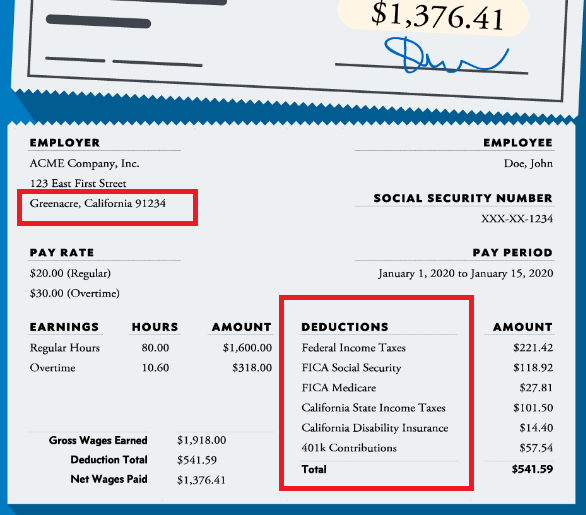

In the state of California, several deductions apply to your paycheck, but do not panic! Some deductions may not have to be made because you do not meet the income levels or you are not affiliated with the plans offered by your company.

If you want to know more about the deductions that apply in California, you will find an easy-to-understand explanation in this article.

How is my Take-Home Pay affected in California?

You may have probably heard someone you know say it seems unfair that their employer paid them less money than what was established in their contract. Most likely, that person must have surely forgotten about paycheck deductions.

Paycheck deductions are a constant concern for workers since they are often not informed about how much money their employers are going to withhold from them. Calculations may not seem easy, but with the information we have for you, this slight difficulty will not prevent you from estimating how much money you will receive in your paycheck.

To make the deduction calculations, it is important that you first know what the California tax regulations are and the reason why the deductions are made.

California State Income tax

In the state of California, the tax system is similar to the one used for calculating federal taxes, thus, it is a progressive system in which the more money you earn, the more taxes you will have to pay. In addition to the federal taxes that you must pay, the state income taxes are added.

There are 9 levels of income and these vary depending on whether you are single, married filing separately, married filing jointly, or if you are head of a household.

California is the state with one of the highest tax rates in the country; even the highest level has a tax rate of 12.30%, which makes it the highest in the country. However, this rate is only imposed on people who earn around $ 1,000,000.00 or $ 2,000,000.00 for joint filers.

California tax rates range from 1.00% to 12.30%. In this PDF, you can check the 9 income tax brackets and the corresponding tax rates. At the end of the sheet, you will find a short tutorial on how to use tax levels and rates to calculate the tax.

Click here to calculate your California State Income Tax.

State Disability Insurance (SDI)

Another paycheck deduction that is applied in California is related to disability insurance. It is one of the few states to require this withholding, which many people find a bit inappropriate, but it is certainly a good option to prevent you from running out of money in the event of a sudden disability (short or long term).

On your paycheck, your employer will withhold 1% of your taxable wages, making the total amount approximately $ 122.00 per year, and the maximum is $ 1,229.00.

Federal Income Taxes

Regarding these taxes, when you enter a new job it is almost certain that your future employer will ask you to fill out the Form W-4, and depending on what you declare, the amount of your deduction is determined.

In previous years, people wrote their allowances on this form and claimed exceptions depending on their marital status, number of dependents, and the jobs they had. It was a somewhat tedious process since each allowance had its own code and you had to be very careful not to make mistakes.

Starting in 2020, the Internal Revenue Service (IRS) changed the guidelines, making this form a little easier.

Currently, instead of specifying all allowances and exceptions, you only need to enter dollar amounts of money and specify additional income. In addition to personal information (marital status, additional income, and dependents if you have them). These new guidelines only apply to people who adjusted their working and personal conditions and those who acquired a new job as of January 1, 2020.

For your convenience, here you can download Form W-4 and read the instructions.

Federal Insurance Contributions Act (FICA)

In addition to federal and state taxes, there are other deductions on your paycheck that affect your take-home pay.

FICA is a law that requires all employees to have paycheck deductions made for contributing to the Social Security and Medicare fund. The same happens with the self-employed, they must also contribute to these funds since it is a federal matter and we all must contribute to be eligible for the benefits offered by Social Security and Medicare.

The percentage of the deduction varies each year and depends on your gross income. For the year 2021, the Social Security tax rate is 6.2% and that of Medicare is 1.45%. When making the deduction, employers match that amount to make the full contribution.

In the case of self-employment, the tax rates are the same, but since they do not have an employer, they must cover the total contribution themselves. However, they can then deduct the employer’s portion as a business expense.