By the time we have to pay taxes and send the corresponding forms to the tax authorities, besides the requirements and the money we must pay, it is also very important to know the due dates; this will help us to avoid penalties for not delivering the paperwork on time. So, we must be very aware and, in case we cannot submit the forms on time, there are options provided by the Internal Revenue Service (IRS) to request an extension, one of them is Form 7004.

Completing this form, unlike what we can perceive, is a relatively simple process. All we have to do is carefully read each of the instructions issued by the IRS and thus avoid making mistakes.

If you need to complete Form 7004, keep reading! We have compiled key information for you.

What is Form 7004 used for?

Form 7004 is a formulary used to request an automatic extension (usually 6 months) to complete some forms for business, information, and other personal returns. It is important to remember that the extension of time is only granted to comply with the obligation of submitting the forms; under no circumstances this form extends the time to pay the tax.

We must be attentive and know how to differentiate both situations to prevent mistakes that can end up in sanctions with penalties for not paying the corresponding taxes on the due date.

Once you complete Form 7004 and calculate the corresponding tax (if applicable), the extension will be automatically approved. You do not have to wait for a response informing you that it was approved. However, if you receive a notification it means that the extension was not approved and you must correct the mistake you made if you still have time, everything will depend on your due dates.

How to file Form 7004

As we mentioned before, completing this form is a simple process, you just have to be careful and not make mistakes so that your extension of time is approved.

Identification

In the first 3 lines, you must write your name, address, and identifying number. Regarding the name, if the last time you filed a tax return you had another name, by the time of completing Form 7004, you must write the name you had when you made the last declaration; if the name you currently have does not match the IRS database, your extension will be automatically rejected.

The same happens with the identifying number. You must correctly write your Social Security Number (SSN) or Employer Identification Number (EIN) as the case may be; if you make a mistake, the extension will be rejected.

Part 1

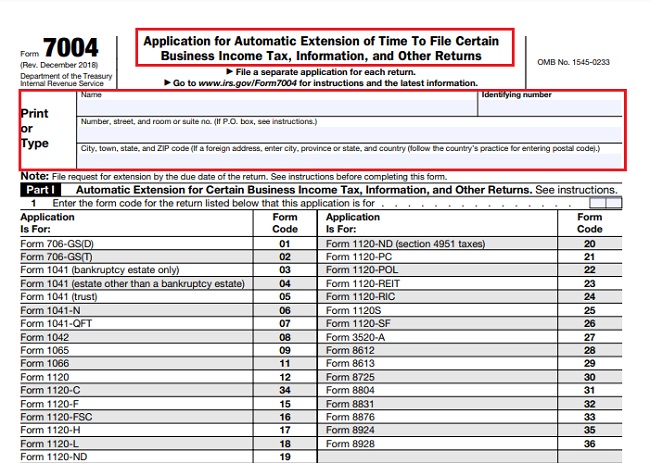

Now, in Part 1 you will be able to verify all the forms whose extension you can request with Form 7004. In the “Form Code” section, verify the number assigned to the form from which you want to request the extension and then write it in the two small boxes on line 1.

Part 2

In Part 2, between lines 2 and 4, you must check the box if your case is one of those that are established in the form. Read carefully and if applicable, put a checkmark in the box.

Now it is time to write the information related to your fiscal year. If your fiscal year is different from the calendar year, you will need to mark the beginning and end of your fiscal year on line 5a. In line 5b you must mark the reason for the short year (if applicable). If your short year ends on any date in June, The IRS will treat you as your tax year ends on June 30th.

Write the estimate you make of your total tax (including non-refundable credits) on line 6. In the return instructions whose extension you are requesting, you can verify how the estimate should be made.

Write the total payments including refundable credits on line 7. If you don’t know how to calculate this amount, check the instructions for the return you want to extend. You can find this information on the official IRS website.

When to file Form 7004

Usually, Form 7004 must be submitted on the due date of the return you want to extend, or before. Everything will depend on the due date of the applicable return (this information can be verified in the instructions of the corresponding form).

E-filing and where to file 7004

In order to fill out Form 7004, you have two options at your disposal, either through the internet or by filling it with the IRS.

Online

The IRS provides their online service to fill out this form through the Modernized e-File (MeF) platform. You just have to enter this page and create a session; if you already have one, access and complete the required data to request the extension with Form 7004.

Filling with the IRS

If you do not want to fill out the form electronically, you can do it on paper and send it to the corresponding IRS offices according to the return whose extension you request.

In these images, you can check the address for the different types of forms.