It is normal to feel overwhelmed when you come face to face with starting a new business and applying for a business license in Utah. Any transactions involving filling out forms from the government can be time-consuming and confusing.

But, there’s always an easy way to apply for a business license in Utah. So if you are located in Utah, carry on reading to get the entrepreneur in you up and running.

When starting your own business in Utah there are a few things you have to know, before you get onto the paperwork. The first one is to identify the kind of business you want to undertake and understanding there is a difference in getting licensed to open a garment store and to starting a law firm.

Costs are another concern. You have to know that the permits can be expensive depending on the type of company you want to operate. But, usually, it’s in between $50 and $400 and there might be an additional processing fee of $25. That’s why you must have a flexible budget available.

Get your business set for Utah

After deciding the business you want to tackle, find out if you really need a license because there are some areas of trade that do not need a license in the first place, the important thing it’s to make sure about it.

The number one site you have to visit it’s the Utah government’s page regarding business. Also, you have to take into account that every city and county has its own regulations, so you have to check out the municipality site for the city you are located in, furthermore if you want to expand your company because every location has to have its permits.

The easiest way to get your license and permits are online and the state of Utah will allow it because it is a business-friendly state. The official website to start the process is: https://www.utah.gov/business/starting.html

Depending on the kind of company you want to start there are a few web pages that will come in useful: Governor’s office of Economic Development (GOED), U.S Business Administration (SBA) and Utah Small Business Development Center.

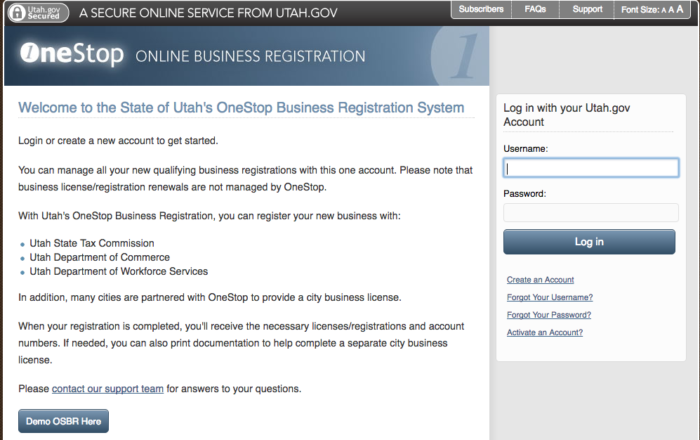

Filling OneStop form

The form OneStop will allow getting the registration that a starting company needs from:

- Utah State Tax Commission

- The Utah Department of Commerce

- Department of Workforce Services and the Department of Environmental Quality.

When finished, you will receive the necessary licenses and account numbers needed for your business.

Most companies need a OneStop registration, but there are some exceptions, such as:

- Expanding a business (adding another location to an existing company)

- A real estate investment trust, business trust or business state in Utah

- Personal service corporation or plan administrators

- A church or church-controlled organization

- Farmer’s cooperative

- A government entity, a special event

- A business that requires the filing of annual employment taxes on Schedule H, Form 1040.

The form is easy to fill, the first steps will be questions with “yes or no” answers and in case of any trouble with the form, the site will help you to solve it yourself with the section “frequently asked questions”, a troubleshooting form or you can always ask to chat live with a customer service representative.

Taxes when starting a business license

The thing that you have to take into account is taxes come along when opening a company, and therefore you will need a Federal Tax Id Number because Utah State requires it for employers, corporations as well as partnerships.

A State Employer Number ID will be necessary for business with employees. If there are no employees yet, there is no need of one. But there are mandatory when you hire workers to get the Federal and State Employers numbers to handle taxes for:

- Social Security

- Medicare Federal

- State and Local Income Tax can be withdrawn.

In addition, a State Sales Tax ID is needed because it is required for retailers and taxable items. That number will also work for a resale certificate number.

Other business needs

Location is one thing that must be decided to apply for a permit, as it was mentioned before in this article. Because each city has its own regulations although each belongs to the same state, Utah in this case.

If you don’t have a location yet, use the address of your agent to identify the municipality from where you need to process the license from.

A name for your business will also be required to fill in the forms in processing your permits. It will be referred to as Doing Business Ass (BDA). In case you formed a Limited Liability Company (LLC), you don’t need a name, just the LLC number, but you can also give to your LLC a name. In such a case, the LLC NAME will be added to the end.

Also, it is important to clarify that the registered name may not be the same name that the company uses for its operations, this alternatives business name are “assumed name, a fictional name, a trademarked name or BDA”.

Trademark or Service Mark

There are differences in a Trademark, a Service Mark and a Name Mark in business licenses in Utah, but the general idea of these concepts is to elevate the product or service because of quality or uniqueness to it.

The objective is to separate your brand from the competitors and that will also need a registration, to do so, there is a special section on the Web page of Utah’s government:

Professional business license in Utah

If you have a profession or an occupation, you will also need to be licensed.

Utah’s Division of Professional and Occupational Licensing (DOPL), in this section of the government’s web site, you can find out the list of professions and apply for your permit.

It is important to know, that you may not legally use a business name without registering it first at the entity or municipality recognized by the Utah state and the Internal Revenue Service (IRS).