If you live in Oregon, you have the duty to pay for state taxes, as well as any other citizen in the United States; this applies even if you are a natural-born-citizen or naturalized.

However, you would probably be wondering why do you pay so much taxes? Well, in a few words, these taxes are used to maintain public facilities, public and higher education, health services, transportation expenses, among others.

Even though, this feels sort of overwhelming, in this article we have gathered the most important and basic information we consider you need to know regarding this topic.

Income tax calculator

When talking about income taxes, Oregon is not a tax-friendly state… While sales tax is 0%, income tax was raised to 5-9,9%; this means that there are no tax charges when acquiring goods or services, instead this is charged in the state revenue.

Although this percentage is higher than others as in the case of Alabama, Louisiana, or Arkansas, you must pay them correctly and promptly. In consequence, here is a tax calculator that will help you to determine your tax depending on your civil status. To use it you just need to follow these steps:

- First, put your taxable income from Form OR-40, line 19.

- Then select your civil status.

- And click on ‘Find my tax’.

Tax Rate

As in all the US, the government charges you depending on your annual income, and there are two factors that will determine the bracket you have to fill. Down below you will see a chart to understand which one is for you.

On the left side, you will see the civil status, on the right, there is the amount of income earned, and in the middle the percentage you have to pay depending on these two things.

Forms

In order to pay your taxes, you will need to fill a form; there are different types of them depending on the situation of each person. Here are the most commonly used:

- OR-40, Oregon Individual Income Tax Return for Full-year Residents.

- OR-40-N, Oregon Individual Income Tax Return for Nonresidents.

- OR-40-P, Oregon Individual Income Tax Return for Part-year Residents.

On the other hand, it is important to emphasize that these documents have been taken from Oregon’s government official website and they correspond to the year 2019; however, you can find the ones for 2020 here.

Payment options

There are several ways to pay your Oregon state taxes; here is a list of the most common:

Credit and debit card

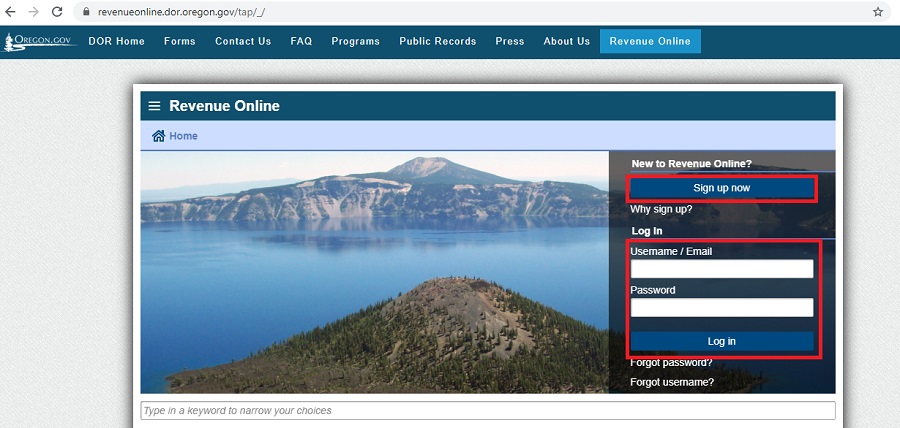

This option is available thanks to a platform called Revenue Online. In it, they accept Visa, MasterCard, and Discovery as well. When you finish your transaction, they will send you a confirmation number.

To proceed with this method, just do the following:

- Go to the official website: https://revenueonline.dor.oregon.gov.

- Log in with your username, password, and follow the instructions.

- If you do not have an account, just click on ‘Sign up now’ to create one.

Phone call

You can also pay through a phone call with your credit or debit card by calling (503) 945-8199 or (877) 222-2346. For TTY: (800) 886-7204.

For this method, it is enough to send a paycheck or a money order with a voucher, plus other requirements depending on the tax, to this address:

Oregon Marijuana Tax

Oregon Department of Revenue

PO Box 14630

Salem OR 97309-5050

We must clarify that not all payment options are available for all Oregon state taxes. You can learn more about it here.

Deadlines

Due to the current situation of the COVID-19 pandemic, tax return filing and payment deadlines were extended until July 15th, 2020. But generally, it is always until April 15th (for individual income returns). For your convenience, here is a list with detailed information:

Tax on cigarette and alcohol

Even though Oregon has no taxes on sales, there is a tax on these two items.

- In the case of cigarettes, they will charge you $1.33 for every 20-package.

- Regarding liquor, it is one of the highest taxes in the whole country, with an amount of $21,98 for each gallon; it surpasses the rate of other states, as in the case of Idaho whose extra charge is just $10,95 per gallon.