A nonprofit is a type of organization that supports social causes and benefit the community. They function through fundraising, and they do not use their income for personal interests.

Also, one of the benefits that characterizes a nonprofit organization is the 501c3 status. This is provided by the Internal Revenue Service (IRS) and gives them the exemption to pay federal taxes.

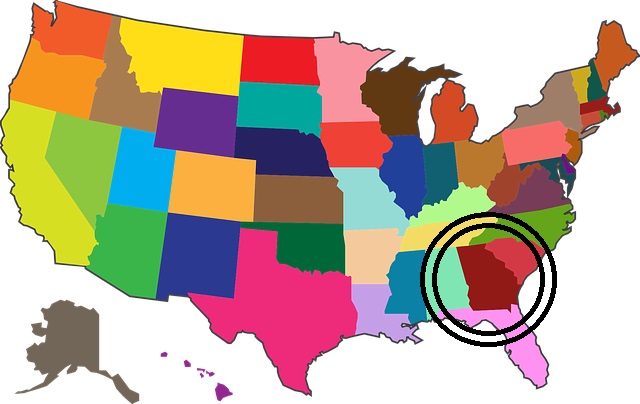

If you are reading this article, we will explain bellow everything you need to know to start a nonprofit in Georgia, since the process may vary from state to state.

Steps to start a nonprofit in Georgia

Choose the board of directors

The board of directors are the ones who dictate the policies of the organization; they lead the group to reach all the objectives successfully and manage everything related to finances and operations.

If you want to create a nonprofit in Georgia, the board must have at least one director, and must be 18 years or older.

Choose a name

Nonprofits require a particular name different from any other to make it distinguishable from organizations already registered in the Georgia Corporations Division.

The availability of names can be verified in the business name database of this Division: https://ecorp.sos.ga.gov/BusinessSearch.

It is important to mention that a name can be reserved for 30 days by submitting the “Name Reservation Request,” which fee is $10.

Also, in the state of Georgia, organizations must carry the words “Corporation,” “Limited,” or “Constitution” on their name.

Select a Registered Agent

A Registered Agent is the person responsible for receiving legal notifications on behalf of the nonprofit organization; it must have a physical office open during business hours in the state of Georgia.

Prepare and present the Articles of Incorporation

These are the documents that mark the formal creation of a nonprofit; they include the place and time when the organization was made official.

Between all this paperwork, the state of Georgia requires a statement indicating the corporation’s compliance with the Georgia Code of Nonprofit Corporations, and the inclusion of essential information such as the name and address of the agent and the directors, and the zip code of the organization’s office.

You must fill these items in the Georgia Secretary of State, via mail or online; there is a $100 filing fee, and the process for approval takes from 5 to 12 business days.

Obtain an Employer Identification Number (EIN)

All organizations in the United States must have an EIN; it is a 9-digit number that identifies organizations.

The EIN is required to open bank accounts, apply for the 501c3 status, and send the organization’s annual returns.

Request the federal tax-exemption status

After finishing everything from above, one of the most important things to do is to obtain a tax-exemption from the Internal Revenue Service (IRS); that is, the 501c3 status for charitable purposes.

To obtain it, you must fill the Form 1023. This is a complete summary of the organization’s structure, and it generally contains 50 to 100 pages of information. When you complete it, submit it to the Georgia Department of Revenue.

The fee for this procedure is $600.

Then, once you receive the 501c3 determination letter from the IRS, the nonprofit will be officially exempt from corporate taxes in the state of Georgia.

It is essential to highlight that any entity or organization requires meticulous planning to get 501c3 status, since there are lots of requirements that must be rigorously prepared and filed.

These types of exemptions apply to organizations that operate exclusively for specific purposes (such as religious, scientific, literary, charitable, or educational) that support public safety, sports competitions, disease prevention, among others.

This status, which is highly challenging to obtain, is decisive for nonprofits since most foundations and financial aid programs do not give grants to organizations without the 501c3.

To get more information about this step, we recommend you to read: Apply for 501c3 nonprofit

What to do if they deny the request?

There is a possibility that the IRS denies the request; this is also called an “adverse determination” and is a very complicated situation.

You can appeal the decision, but it requires an excellent legal-accounting representation.

However, sometimes it is even better to start a new application by following the steps mentioned above.

It is necessary to be meticulous, and if it is possible, to ask the help of attorneys with experience in the matter.

Even if it seems complicated, this process is necessary because the tax-exemption should only be for specific entities (like nonprofits); if any company could request it easily, the state would not be able to sustain itself.