Welcome to Unemployment

Your Guide to Successfully Navigating Unemployment

-

501c7 status • Benefits and filing Requirements

The 501c7 status refers to non-profit organizations, with tax-exemption, characterized by the fact that they do not generate profits. These types of organizations are fraternities, country clubs, hobby clubs, among others. In these groups, all the fundings do not generate taxes (thanks to the 501c7 benefit), but they must be used exclusively for non-profit projects…

-

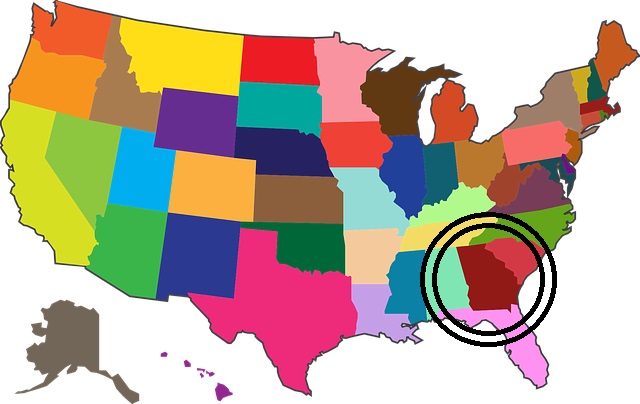

Nonprofit in Georgia • Steps to start and What to do if they deny the request

A nonprofit is a type of organization that supports social causes and benefit the community. They function through fundraising, and they do not use their income for personal interests. Also, one of the benefits that characterizes a nonprofit organization is the 501c3 status. This is provided by the Internal Revenue Service (IRS) and gives them the…

-

Can you get disability for depression? • Benefits and How to apply

In the United States of America, according to general statistics, more than 16.1 million American adults suffer from depression, which would be 6,7% of the country’s population in a given year. At some point in our lives, we have experienced moments or situations that make us feel sad or hopeless, but that does not mean…

-

Private Foundation vs Public Charity • Difference and Benefits

When you want to start a non-profit organization with the 501c3 status (that is exempt from federal taxes), you have to think about how it will be classified: as a public charity or as a private foundation. In this case, the Internal Revenue Code (IRC) separates non-profit organizations according to its purpose, fundraising, and annual…

-

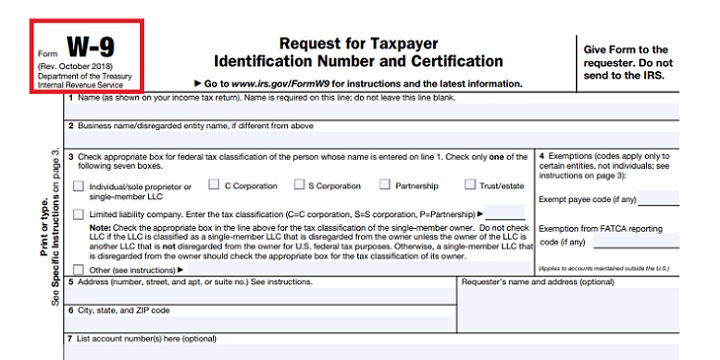

W-9 Form for non-profits • How to fill it and Purpose of the W-9 Form

The Internal Revenue Service (IRS) has numerous forms to require non-profits information about their commercial activity and the specific type of income they have received during the year, and Form W-9 is one of them. The IRS issues this Form in cases where the organization signed a contract with other corporations to perform activities that…

-

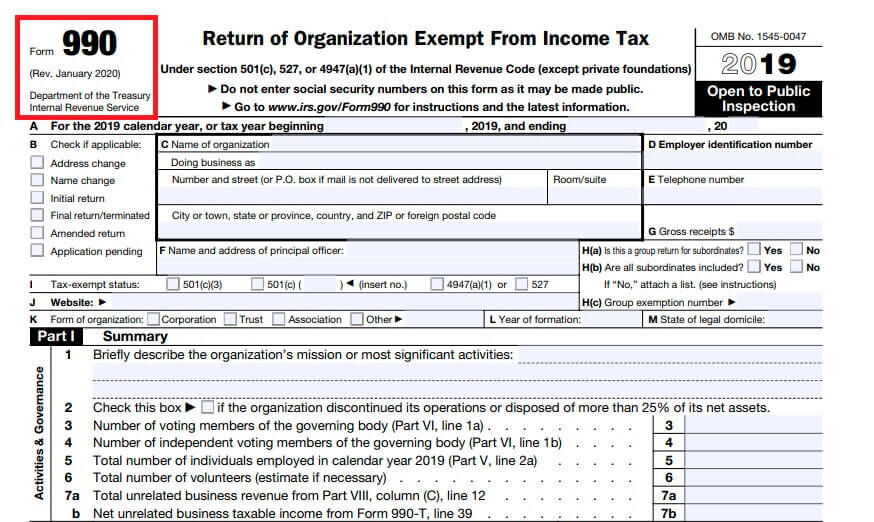

What is form 990 • Requirements and types of forms

Despite being exempt from federal taxes, companies must file annual declarations. Otherwise, the organization would be breaching one of the requirements imposed by the IRS (Internal Revenue Service). To present these declarations, you will need to file Form 990. It seems like a tedious and unnecessary requirement; however, it helps the State to ensure that non-profit…