In the United States, income taxes represent a significant amount of money and a significant contribution to the government; still, not all states must collect them, like Tennessee.

This state created a ‘hall tax’ instead of an income tax, which only applied to interest earn by bonds, dividends, and notes. However, the rate was only 6% in 2016, it went down to 1% in 2020, and now in 2021, it has been repealed.

If you did not know about this and want more information, keep reading this article in which we explain the basic concepts about taxes in Tennessee.

Types of taxes in Tennessee

Even though Tennessee does not have income taxes on wages and salaries, the rest of the taxes are still managed by the state Department of Revenue. This money is often used as a resource for social programs, public health, public schools, transportation, and other services.

Income taxes

As we mentioned before, the only tax for personal or work income was the ‘hall income tax’ created in 1929.

By 2016, the rate was 6%, and it only applied to bonuses, dividends, and interests derived from investments. People who utilized ‘single’ filing status were exempt from paying taxes on the first $1,250 of taxable income. Additionally, ‘joint filers’ were exempt on the first $2,500.

Other exemptions included:

- Any 65 years old person or older with an annual income below the limit; $37,000 for single filers and $68,000 for joint filers.

- Any 100 years old person or older.

- Blind people.

- Quadriplegic people.

However, after 2016, the state decided to reduce this tax by 1% each year until 2021, when it would be completely repealed (this was even published on their official website).

In other words, Tennessee is now one of the 9 states in the US that do not have income taxes, along with Alaska, Florida, Nevada, New Hampshire, South Dakota, Texas, Washington, and Wyoming.

Sales taxes

On the other hand, while it may seem ‘good’ that Tennessee has no income taxes, the complete opposite happens with sales taxes.

It has one of the country’s highest rates, with a general base of 7% that can increase to 9.55% because of additional taxes for counties and cities.

This tax is applied to tangible property like food, books, jewelry, clothing, computer software, etc., and services like installation/repair of personal property, satellite television, laundry, etc.

Property taxes

Similar to income taxes, the property tax in Tennessee is one of the lowest in the US. The effective rate is 0.64%.

However, the county where you live will increase that number, so keep that in mind.

Other taxes

We already mentioned the main three taxes and the ones that most people ask about, but here are some of the rest:

If you want detailed information about each type of tax, as well as due dates, forms, and instructions, visit the official website of the Tennessee Department of Revenue: https://www.tn.gov/revenue/taxes.

Payment options

Most of the tax returns and payments must be made online through the Tennessee Taxpayer Access Point (TNTAP).

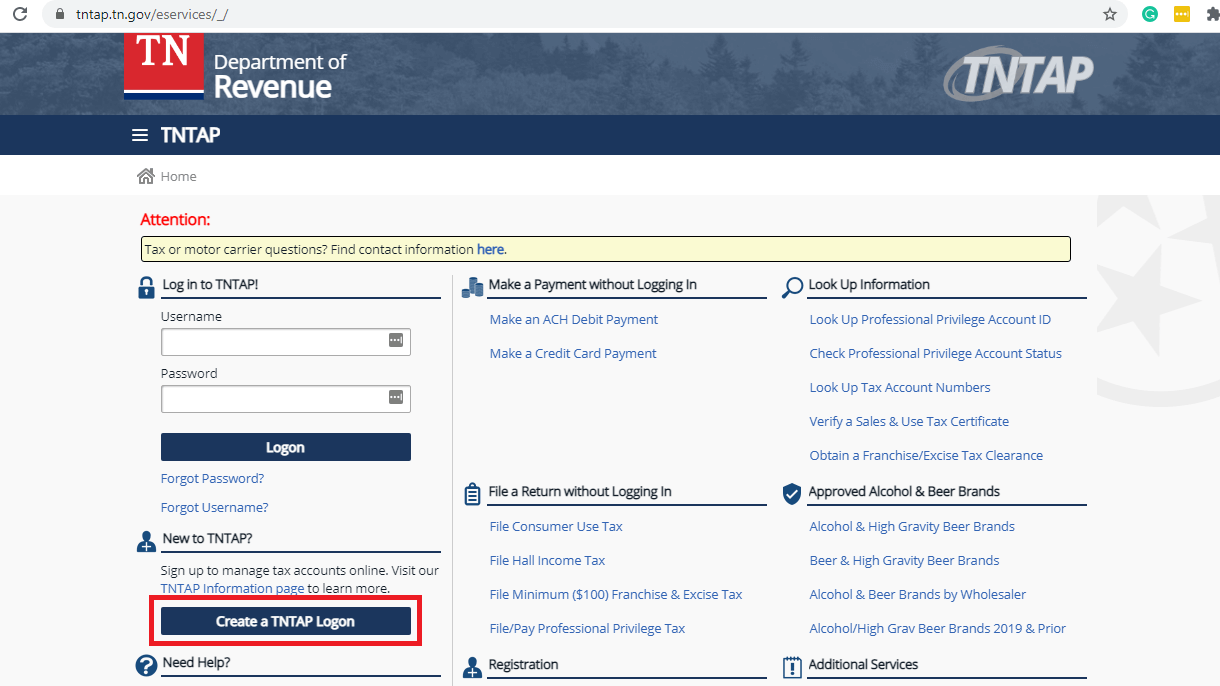

The first step to do this is to have an account. If you do not have one, go to https://tntap.tn.gov/eservices/ and click on ‘Create a TNTAP Logon.’

Then, just follow the prompts and answer the questions. Some of the required information to register in TNTAP is:

- Account number.

- Account type.

- ZIP code.

- FEIN, ITIN, or SSN.

- Legal business name (as it is registered with the DOR).

- Either one of your last 3 payment amounts or a letter ID.

- A valid email address.

When you finish, you will be able to file your taxes, manage your account, and view correspondence.