If you live in Ohio, you have the right to receive Unemployment Insurance Benefits. It is a program that provides extra help (to carry their needs) to all workers who have lost their jobs through no fault on their own.

It is issued at the Ohio Department of Job and Family Services (ODJFS), and the process is very simple. However, you will need to meet some requirements.

In this article, we will show you the eligibility criteria, how to calculate the amount of your benefits, and the application process in the state of Ohio.

Eligibility

The criteria to apply for unemployment benefits in Ohio is similar to other states. There are three main requirements:

Monetary criteria

To evaluate your eligibility, the Ohio Department of Job and Family Services (ODJFS) will look at your earnings of a one-year “base period”; this period ranges the first 4 quarters of the last five calendar quarters preceding your claim’s date.

For example: If you apply in May 2020, your base period would be from January 2019 through December 2019.

To be selected, you must have worked at least 20 weeks, and earned at least $269 per week during the base period.

Reason of unemployment

On the other hand, you have to demonstrate that you are unemployed through no fault of your own. Some of the valid reasons are:

- Dismissal due to the reduction of personnel in the company.

- Dismissal due to the inability to perform your work correctly; this can include physical and psychological reasons.

- Justified resignation. However, you must prove that you did not want to resign, but there was no other choice; it can be for reasons like unsafe work conditions, sexual harassment, late payment, etc.

Note that, by the time you are completing the application, you will be asked to give proofs about the circumstances that made you lose your job, so be sure to provide only real information.

Search for work

Besides proving the reasons for unemployment, the state of Ohio requires you to keep looking for a job.

This will prove the ODJFS that you have the physical conditions, the intentions, and the availability to work. Remember that you are making the application because of need, not comfort.

If you find a suitable offer, you must accept it; otherwise, if the unemployment commission finds out, you will be cut out of the benefits (unless you have a valid reason to reject it).

➡ READ ALSO: How to apply for social security spousal benefits?

Required information

- Your name, address, telephone number, and email.

- Social Security number.

- Driver’s license or state ID number.

- Data of your former employers for the past six weeks (company name, address, phone number, supervisor’s name and email, and salary).

- The reason and the date you stopped working for each employer.

- Data of your dependents (if any) (names, Social Security numbers, and birth date).

- Proof of US citizenship or legal authorization to work in the US.

- Your current or regular occupation and skills.

- If you are a newly discharged veteran, member 4 copy of Form DD-214.

Benefit amount

- Use this guide to calculate your benefits by yourself.

- Or use this Benefit Estimator: http://www.odjfs.state.oh.us/uiben. Remember that this option will not show the exact amount; it is only an approximate.

In general, you can receive a máximum of $480 for a máximum of 26 weeks.

Application process

There are two options to apply for unemployment in Ohio:

By phone

You can apply by calling the ODJFS to 1-877-644-6562 (TTY 1-614-387-8408). They are available Monday through Friday, from 7 am to 7 pm; Saturday from 9 am to 5 pm, and Sunday from 9 am to 1 pm.

Online

On the other hand, this option is available 24 hours a day, 7 days a week.

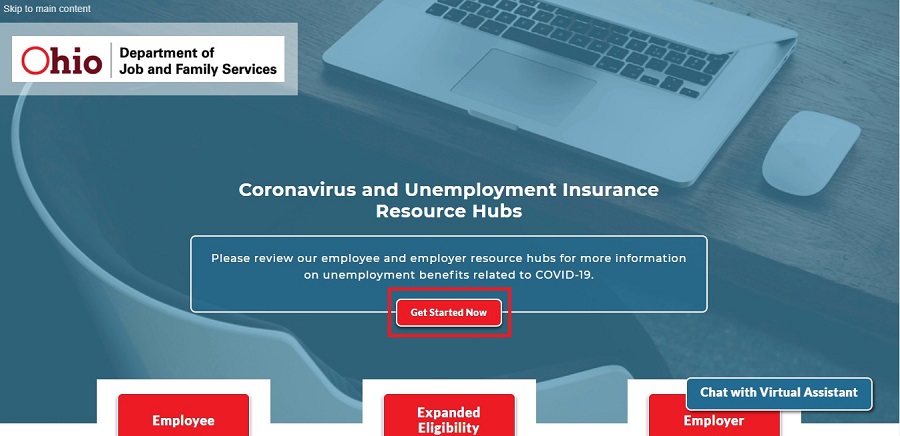

- Go to http://unemployment.ohio.gov and click “Get Started Now.”

- Answer the qualifying questions.

- If you are eligible, click “Continue”; you will be directed to the standard unemployment benefit tool. If you are not eligible, other options will appear.

- Create your Claimant account (complete the two steps). If you already have an account, click “Cancel” and enter your SSN and PIN on the next page.

- Once you log into your account, click “File a New Claim for Unemployment Benefits.”

- On the next pages, follow the instructions and provide information about your last jobs, payments, school enrollment, dependents, occupation preferences, etc.

- Select a “Getting Paid” option: Whether a debit card, or a direct deposit to a bank account. Then click “Next.”

- And you are done! Click “Agree” to certify that all the information is accurate.

If you have further questions about the process, you can go back to the main page and click on “Chat with Virtual Assistant” to get help.

Once you finish your application, the ODJFS will send you a Claim Instruction Sheet (by mail or email) with further information about your weekly claims and payments. Sometimes they will request more documents (depending on the case), so do not worry if that happens.