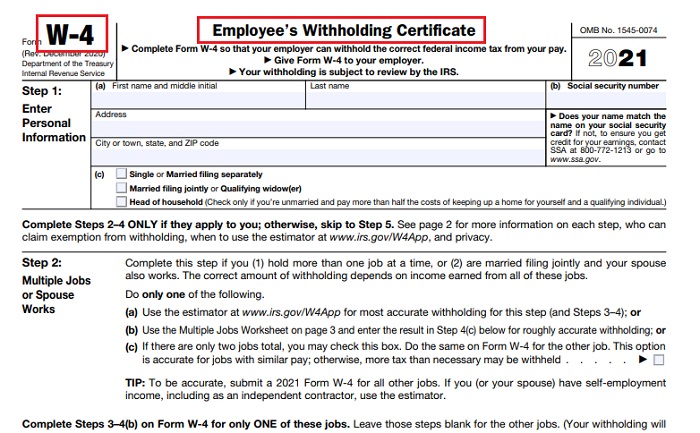

When we enter a new job or our work situation changes (either because we acquire an additional job or our income changes significantly), it is almost certain that our employer will ask us to complete the Form W4, and many times we do it without even knowing what information we are providing.

But it turns out that the content of this form is extremely important when calculating how much federal income tax from our salary our employer will withhold.

Putting it that way, it may sound a bit overwhelming, but in reality, it is very simple. So, if you need information on how to complete this form you have found the right article; keep reading and we will explain how to do it.

What is my W4 used for?

On its official website, the Internal Revenue Service (IRS) tells us that we must complete Form W4 “so that our employer can withhold the correct amount of federal income tax from their pay.”

What does this mean? As we mentioned at the beginning of this article, when we complete this form we are not doing more than informing our future employer how many allowances we have in our favor; the withholding they make from our income will depend on it.

You must surely be wondering what “allowances” are and how they work? It is common to confuse them with “exemptions”, but these are completely different terms.

This is why you should first understand the difference and, once this doubt is clarified, you will be able to complete your form without any inconvenience or missed information.

Allowances Vs. Exemptions

First, let’s remember that every year we have to pay tax on our income, but the tirade begins when we ask ourselves: What is the total amount of our income? Should we make deductions? What income should we count for the calculation?

At the time of filling out our returns, we have at our disposal the instructions that the IRS has very diligently provided for us. In each document, they tell us how to do these calculations depending on the form we wish to complete.

Now, when we are going to calculate our income and later the amount of tax that we must pay, we must pay attention (among other things) to the deductions that we have in our favor in order to reduce the amount to be paid.

And this is the moment when allowances and exemptions come in.

- On one side, we have that exemptions are circumstances that reduce taxable income and are claimed on Form 1040.

- While allowances reduce the amount of your income that is withheld for taxes and claimed with Form W4.

Both terms are closely linked due to the fact that the amount of allowances to claim (Form W4) depends on the number of exemptions you can claim on Form 1040. This does not mean you have to claim the same amount of allowances and exemptions, you can decide to claim a smaller amount of allowances than the ones you have the right to.

Types of W4 Allowances

The allowances that we can claim when completing Form W4 will depend on our marital status, whether or not we have dependents, and also how many jobs we have. So, in order to complete this form, we must specifically address our case and not let ourselves be guided by others.

0 Allowances

You may claim 0 allowances if someone else claims you as their dependent when filing their taxes. For example: college students when their parents claim them as dependents.

By entering “0”, you will be made a maximum tax withholding each time you receive your paycheck.

1 Allowance

In this opportunity, you must claim “1” if:

- You are not married and have only one job.

- If you fill out Form W-4 as a head of household.

- You are married but you are filing a joint return.

2 Allowances

You may mark “2” if:

- You have 2 or more jobs and are single. This process can be done in 2 ways: You make 1 claim for each job or you can claim them all in a single job and put “0” in the others. For example: if you have 2 jobs, you claim 1 in A and B; or you can claim 2 in Job A and 0 in job B.

- You also have the possibility of claiming an allowance for yourself and one for your spouse. In this case, you should keep in mind that if you and your spouse decide to file the W4 separately, you must calculate it based on your own income apart from each other. But if you do it jointly, you cannot both claim the same allowances; you must split them between the both of you, in the way it best suits you.

3 Allowances (or more)

Finally, you will claim “3” if:

- You are married and have a child, but if you have 2 or more children you can claim more allowances.

What to claim on my W4?

Now that you are informed about what are the allowances, you can decide whether to claim them or not, since it is not mandatory to do so, and the amount you claim is also up to you.

But something you should know is that, when it comes to deductions, you will receive less money in each paycheck, since what you deduct will be used to pay taxes on your income. If you decide not to claim allowances, you should be prepared to pay the corresponding invoice when the date to pay taxes comes.

If you still have any questions regarding this form, you can visit this website where the IRS answers the most frequent questions related to this.