Many of the social assistance programs in our country establish a certain amount of income within their eligibility requirements. These amounts vary depending on various factors such as the state where you live, the number of people that live with you, and other requirements of the program to which you are applying.

However, we often do not know how to calculate our income since we must make deductions or omit certain money entries outside of the total amount. In this article, we will talk specifically about the income limits for Medicaid.

Currently, Medicaid is the state and federal program with the highest health coverage in the country. This program offers health coverage to over 72 million inhabitants in the U.S, including children, pregnant women, low-income families, people with disabilities, and seniors.

If you don’t know how to calculate your income to qualify for Medicaid, here’s how to do it.

Medicaid Eligibility Criteria

In addition to the income limits, to apply for the health coverage offered by Medicaid you must meet other eligibility requirements.

Although it is a federal program, the state governments are the ones that administer the applications; this means that the requirements vary from state to state. However, since it is a single program the guidelines are general and can be divided into 2 large groups.

Financial Requirements

To qualify for the health coverage offered by Medicaid, you must meet the eligibility requirements related to your income as a parent or as an individual applicant. Generally, the standards are based on the federal poverty level (FPL) according to the area where you live.

Local authorities establish the limits based on an economic study that includes minimum wages, cost of living, and the possibility to acquire employment.

Non-financial requirements

Although income level is one of the most important requirements for these types of programs, it is not the only one you should pay attention to.

Depending on the program you choose, for example, The Children’s Health Insurance Program (CHIP) or if you are pregnant or have a disability, you must meet the requirements of each program in addition to:

- Being a US citizen (or if you are a foreigner, being a legal resident).

- Being an inhabitant of the state where you are applying for benefits.

- And being within the age range.

For your convenience, in this link, you can verify the eligibility requirements of CHIP and pregnant women.

How do I calculate my income for Medicaid?

There are two ways to calculate your income. Depending on the program you want to apply to, you may use the MAGI method or Supplemental Security Income Program method.

MAGI method

In 2010, the government through The Affordable Care Act changed the parameters to determine eligibility based on income and established a new method to do this; before this, the methodology used was from the Aid to Families with Dependent Children program.

This new process is based on the Modified Adjusted Gross Income (MAGI) which is your adjusted gross income (AGI) plus:

- Social Security benefits (not included in your gross income).

- Tax-exempt interest.

- And foreign income excluded.

An easy way to do it is by following this formula:

- Calculate your adjusted gross income (AGI).

- Add your tax-exempt interests (those that are not subject to federal income tax).

- To the amount above, also add your non-taxable Social Security benefits (not included in your gross income).

- Lastly, once you’ve added all of the above, add your excluded foreign income.

By adding all this up, you will get your Modified Adjusted Gross Income.

This method is used for the Medicaid, CHIP, and Basic Health Program (BHP) programs.

Supplemental Security Income Program (SSI) method

This method is used for people who are exempt from the MAGI method, thus, it applies to people with disabilities, adults over 65 years of age, and people with blindness.

It is a relatively simple method, and to calculate your income limits for Medicaid using this methodology you only need to know the following:

- Earned (wages, some royalties, fees, net income from self-employment).

- And unearned (workers’ compensation, pension payments, Social Security benefits, unemployment benefits, and any other income you don’t earn).

*Certain incomes should not be counted when calculating your income to receive SSI. You can verify this information on this page.

So, although the information above is related to the Social Security benefits provided throughout the SSI Program, the method used to calculate a person’s income and find out if they can receive such benefits is the same that you should use if you are 65 years old or more, if you have a disability or if you are blind and want to apply for Medicaid.

The same goes for Medicaid Saving Programs.

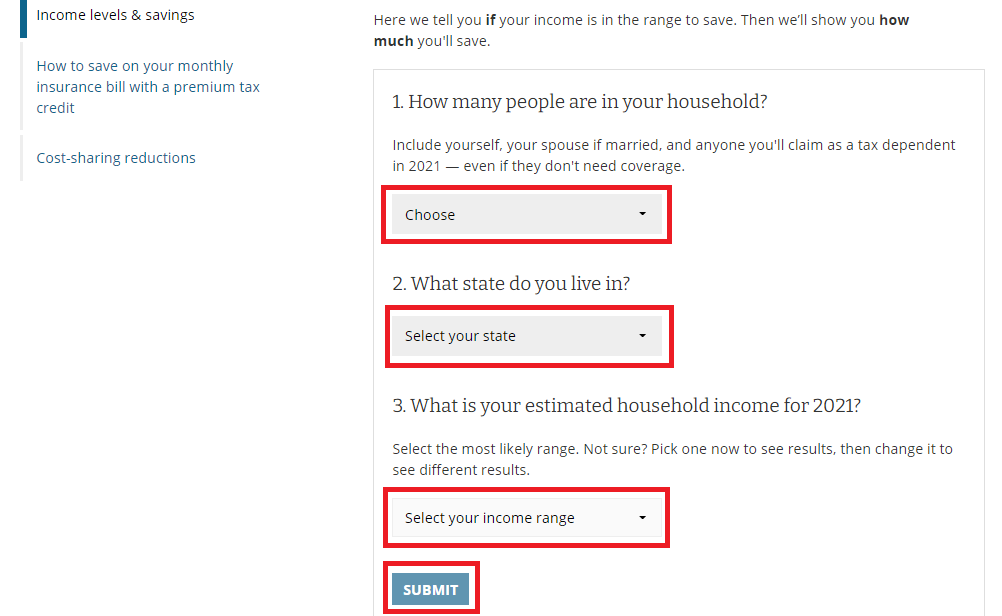

On this page, you can take a mini-test and find out if you may be eligible for Medicaid benefits based on your income, the state where you live, and the number of people who live with you.

➡ READ MORE: Are Medicare Advantage Plans bad?

What is the maximum income for a single person to get Medicaid?

This is a question that we frequently ask ourselves, but the truth is that there is no concrete answer since it will depend on the state where you reside.

For example, in the state of California, the income limits for Medicaid for a single person are $17,131 while in Texas it is $25,503.

Likewise, in the state of New York for a single person the income limit is $17,131, in Georgia, it is $31,814, in Delaware $17,131, and in Illinois $17,755.

In consequence, each state has its own limits based on economic studies specific to each jurisdiction. Regarding the limits for Medicaid 2019 and limits for Medicaid 2020, the same situation happens, since each state establishes its own limits, it is a matter of requesting information from the corresponding agencies.

If you want to know the limits of the state where you live, we invite you to contact the corresponding offices. On this page, you will find the contact information for the Medicaid offices in each state.