When talking about state income taxes, it can be kind of tricky due to the several classifications and variations on this tribute, and California is not the exception.

Regarding this state, it currently has (as of 2020) the highest income tax rate in the US, ranging from 1 to 13.3 percent, along with sales taxes that are also the highest in the nation, ranging from 7.25 to 10.50 percent.

In consequence, in this article, we have summarized the main information that will help you to understand -and calculate- how much you will have to pay.

Tax Brackets

The first thing you should know is that, in California, these taxes are calculated progressively; this means that the percentage that you have to pay will depend on the final amount of your income. In fewer words: if you earn more, you pay more; if you earn less, you pay less.

In consequence, the state has created the ‘brackets’, which are the different classifications according to your earnings and filing status.

For Single Individuals and Married Filing Separately

If you earn: You must pay:

between $0 and $8,809 1% between $8,809 and $20,883 2% between $20,883 and $32,960 4% between $32,960 and $45,753 6% between $45,753 and $57,824 8% between $57,824 and $295,373 9,3% between $29,5373 and $354,445 10,3% between $354,445 and $590,742 11,3% between $590,742 and $999,999 12,3% $1,000,000 or more 13,3%

For Married Individuals Filing Jointly

If you got married and you and your couple (living in California) have not filed income taxes jointly, you should consider this status, as it can bring much profit to both of you. Not only because you will gather all income to pay just one bracket, but it could also give you some benefits such as eligibility for some tax credits or higher tax returns. Down below you can see the ranges:

If you earn: You must pay:

between $0 and $17,618 1% between $17,618 and $41,766 2% between $41,766 and $65,920 4% between $65,920 and $91,506 6% between $91,506 and $115,648 8% between $115,648 and $590,746 9,3% between $590,746 and $708,890 10,3% between $708,890 and $1,181,484 11,3% between $1,181,484 and $1,999,999 12,3% $2,000,000 or more 13,3%

➡ READ ALSO: How to request unemployment benefits in California?

For Head of Household

If you earn: You must pay:

between $0 and $17,629 1% between $17,629 and $41,768 2% between $41,768 and $53,843 4% between $53,843 and $66,636 6% between $66,636 and $78,710 8% between $78,710 and $401,705 9,3% between $401,705 and $48,2047 10,3% between $482,047 and $803,410 11,3% between $803,410 and $999,999 12,3% $1,000,000 or more 13,3%

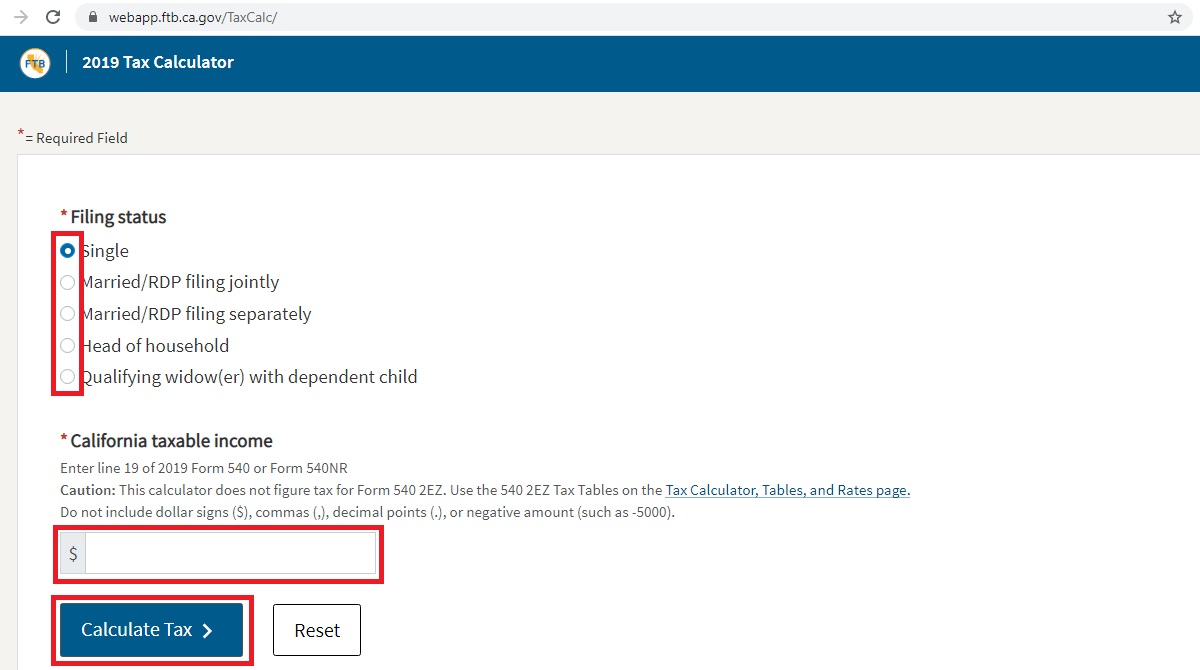

Now, if you do not feel confident enough with these charts, and you want to calculate how much you have to pay specifically, here is a Tax Calculator; it belongs to the Franchise Tax Board of California, so it should be very accurate: https://webapp.ftb.ca.gov/TaxCalc.

- Select your filing status.

- Write your taxable income (line 19 of Form 540 or Form 540NR).

- Click ‘Calculate Tax.’

NOTE: Keep in mind that this tool is currently for the 2019 tax year. If you want to use it for 2020, you will have to wait until it is available.

Tax Deductions

There are two main types of tax deductions in California: Standard and Itemized. In order to understand the difference between both of them, we recommend you to watch this video:

After understanding both concepts, here are the amounts of these deductions for 2019 in California.

Standard

Itemized

Due dates

One of the principles of Tax Law is that the annual income tax return must be filed the following year. For example, you will pay your 2019 taxes in 2020, your 2020 taxes in 2021, and so on.

The stipulated time to file your 2019 taxes is between January 27th and April 15th.

You can always pay your income taxes online or with a debit or credit card, but according to the IRS, you can also use simple options like cash, money orders, or even personal checks.