Category: Form

-

Fill Out Section 8 Application Online Free

Are you searching for the requirements and instructions on filling out the online section 8 application form? Or you may be thinking of an alternative way to get this type of form. Unfortunately, there is no possible trick of obtaining and completing the section 8 application unless the local housing authority provides and accepts the… Read more

-

How to Get a Copy of My Paid Form 2290 Schedule 1?

Heavy Vehicle Use Tax (HVUT) is a tax that you pay to the federal Internal Revenue Service (IRS) for annual national highway use. It applies to the vehicles operating on public highways at a gross weight of 50,000 pounds. If you plan to pay your HVUT, you must be curious to know how it works. The… Read more

-

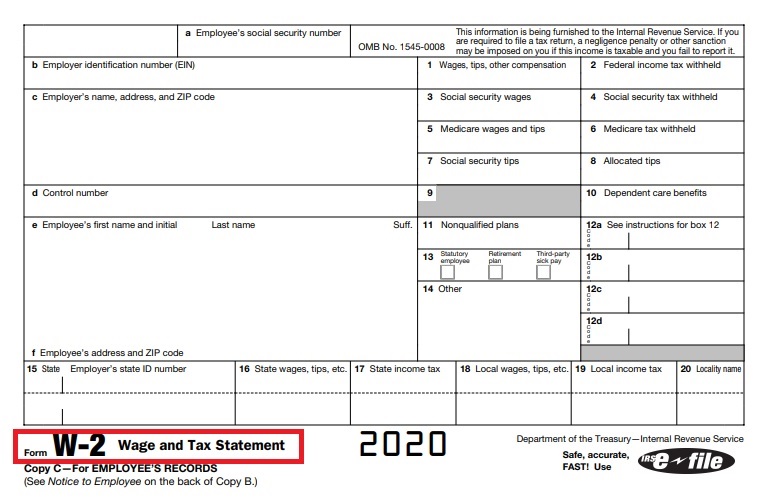

How to Get a W-2 Copy from 2015

Sometimes there can arise a situation when you suddenly need a copy of your W-2 form; maybe because you are expecting payback from past taxes, facing an audit, or a mortgage company is demanding it for your new house. Apart from that, you may be asked to provide your income proofs to inquire about your tax… Read more

-

How can I get a copy of my W-2?

One of the requirements imposed by the Internal Revenue Service (IRS)on employers is to fill out the W-2 form. In this document, they have to report information related to their employee’s wages, and the state and federal taxes that are deducted from their paychecks. This information is essential to prepare tax returns that will then… Read more

-

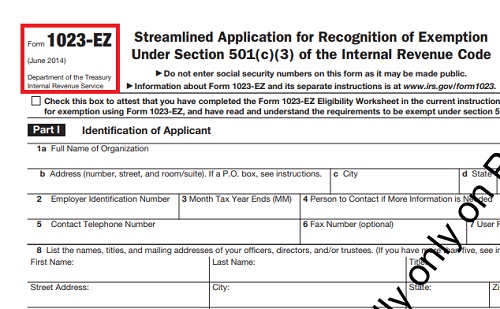

Form 1023-ez • Eligibility and How to apply

In some cases, due to many requests, the Internal Revenue Service (IRS) changes some paperwork to simplify its processes, like the Form 1023-ez, which is a “streamlined” type of Form 1023. The last one is used to apply for recognition as a tax-exempt organization under Section 501c3 (non-profit organizations); however, this process may be considered… Read more

-

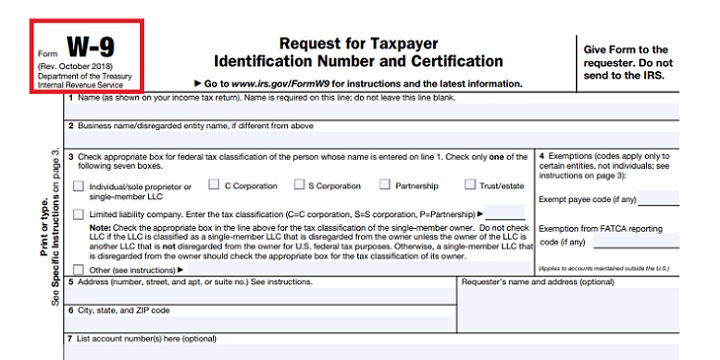

W-9 Form for non-profits • How to fill it and Purpose of the W-9 Form

The Internal Revenue Service (IRS) has numerous forms to require non-profits information about their commercial activity and the specific type of income they have received during the year, and Form W-9 is one of them. The IRS issues this Form in cases where the organization signed a contract with other corporations to perform activities that… Read more

-

501c7 status • Benefits and filing Requirements

The 501c7 status refers to non-profit organizations, with tax-exemption, characterized by the fact that they do not generate profits. These types of organizations are fraternities, country clubs, hobby clubs, among others. In these groups, all the fundings do not generate taxes (thanks to the 501c7 benefit), but they must be used exclusively for non-profit projects… Read more

-

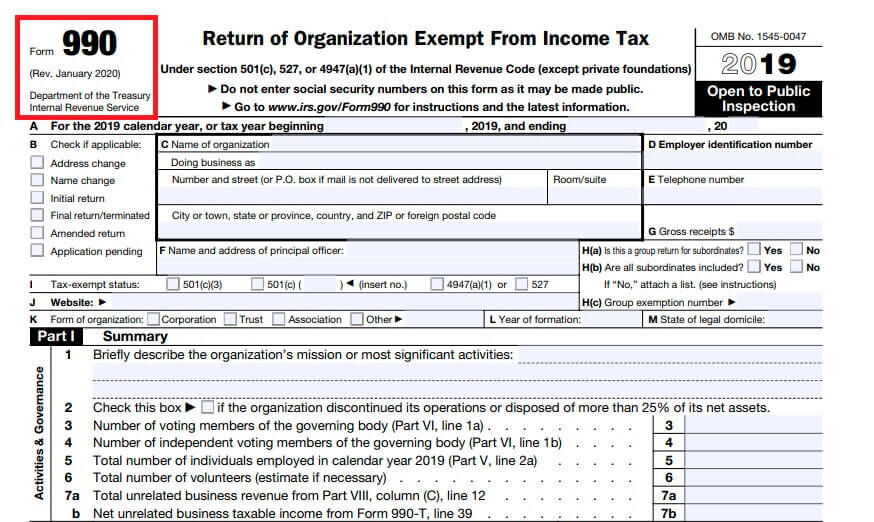

What is form 990 • Requirements and types of forms

Despite being exempt from federal taxes, companies must file annual declarations. Otherwise, the organization would be breaching one of the requirements imposed by the IRS (Internal Revenue Service). To present these declarations, you will need to file Form 990. It seems like a tedious and unnecessary requirement; however, it helps the State to ensure that non-profit… Read more