The Internal Revenue Service (IRS) has numerous forms to require non-profits information about their commercial activity and the specific type of income they have received during the year, and Form W-9 is one of them.

The IRS issues this Form in cases where the organization signed a contract with other corporations to perform activities that are different from their original purpose (declared in the Articles of Incorporation).

In this article, we will guide you on how to use Form W-9 for the specific case of non-profit entities and how you should fill it.

What’s the purpose of the W-9 Form?

Although non-profit organizations can have tax-exempt status, they must fill the W-9 Form when they sign contracts with another business or corporation during the fiscal year.

For example, if you run an Animal Refugee Center and you provide a particular veterinary service to a company, they will send you a W-9 tax-exempt form, because you are doing a specific activity that is not included in your Articles of Incorporation.

Once you receive a W-9 form, you should fill it and send it as soon as possible to the person or organization who requested it.

W-9 Forms are an essential part of the taxation procedure, and you must complete it on time.

Where can I find it?

There are two ways to get the W-9 Form:

- The business entity or the person who requested you to complete the W-9 Form may send you the Form.

- In case they don’t, on the IRS website, you can find the Form and all the instructions to fill it.

➡ ALSO, you may want to read: How to apply for 501c3 nonprofit status

How to fill the W-9 Form?

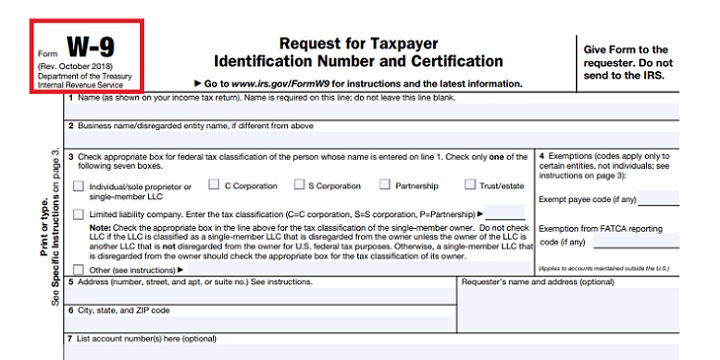

These are easy instructions to complete the W-9 Form:

- Line 1- Name: the first line you have to complete is the name of the non-profit organization. Ensure this name is the same as shown on the tax return.

- Line 2 – Business name: this line must be filled only if the non-profit corporation has a business name different from the one in the tax return. In case there is not a business name, leave this line in blank.

- Line 3 – Federal tax classification: mark the checkbox “other” and write “non-profit corporation exempt under section 501(c)(3).”

- Line 4 – Exemptions: in this line, you may write the code for a specific exemption, but they usually apply to “certain entities, not individuals.” If you want to be sure about this part, read the instructions on page 3.

- Line 5 – Address: write the specific address (number, street, and apartment number). This should be the mailing address of the non-profit organization.

- Line 6: in this line, you must write the city, state, and ZIP code.

- Part I – Taxpayer Identification Number: in this line, you have to write your Employer Identification Number issued by the IRS, also known as “EIN.”

In case you applied to get the EIN, but you have not received it yet, write “applied for”; and if you do not have it, read here to know how to do it.

- Part II – Certification: you have to sign and enter the date to certify that the information you are providing is correct and that your non-profit organization will not be subject to a backup withholding.

What to do after completing the Form?

Finally, when you finish to complete the W-9 Form, send it to the person or the organization that requested it.

This is an essential step in the tax business and recordkeeping procedures, so you should complete it promptly.

You may send it back through an email, which you should encrypt before. But if you go for this option, we recommend you to obtain the consent of the person or the company before you send the email, since some people prefer to receive documents by fax or postal service.

Also, remember that if you want to receive the tax-exempt status, you must require it directly to the IRS. Just because you created a non-profit, it does not mean that you already have that benefit; you will need to fill specific requirements before, and Form W-9 is one of them.