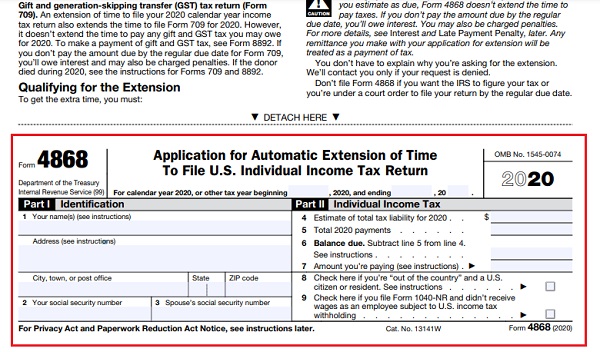

As you should know, under normal conditions we must pay and file our tax returns between January 1st and April 15th, nevertheless, the Internal Revenue Service (IRS) has extended this deadline until May 17th, 2021. However, if we are not able to complete all the forms and submit all the paperwork by that date, the IRS also offers us the option to request an extension that lengthens the time to comply with this obligation. In this case, the request made throughout Form 4868.

During the application, you must complete the return whose extension you need at the same time as form 4868 to obtain the automatic 6-month extension.

If you are already experiencing a shortage of time before completing your personal income tax return, in this article you can find the steps to solicit more time.

What is IRS Form 4868 used for?

As we mentioned above, the main objective of this form is to request an automatic 6-month extension that allows you to file your tax returns after the general due date (usually April 15th of each tax year). It is worth noting that if you reside outside the U.S, this extension will be of only 4 months.

Remember that form 4868 is an extension of time to submit returns and other documentation that needs to be sent to the IRS at the time of a tax return. This form does not extend the date on which you must pay, it is only an extension for completing the corresponding forms.

Who must use it?

Since this form is used to request an automatic extension to file the personal income tax return in the U.S, the people who must use it are the individual taxpayers; corporations and other businesses use another type of form.

In short words, if you are an individual taxpayer and require an extension to file forms 1040-SS, 1040NR-EZ, 1040, 1040EZ, 1040NR, 1040A, or 1040-PR, you must do it through the IRS Form 4868.

Likewise, if you have doubts, you can check the return instructions and verify which is the appropriate form to request an extension.

Due date

This form must be presented to the IRS by April 15th, 2021.

Where can I get Form 4868?

For your convenience, click here to download Form 4868.

Filling Form 4868

In addition to the form, you can also read the instructions on how it should be completed. It is a quick and easy process since you only have to complete basic information.

From lines 1 to 3 you must write your name, addresses (including the zip code), your Social Security Number as well as your spouse’s.

Now, in Part II you must complete as follows:

- Line 4: write the estimated amount you think you will have to pay to the IRS.

- Line 5: add everything you paid during the year.

- Line 6: write the “balance due” which is nothing more than the result of subtracting the amount from box 5 from box 4.

- Line 7: inform the IRS of the amount you want to pay at the time of submitting the form.

- And you should only check boxes 8 and 9 if you are requesting the extension for Form 1040-NR or if you aren’t living in the U.S.

E-filling and where to mail Form 4868

In order to request the extension, you can do it in 2 simple ways.

- Using the Free-File platform.

- Downloading the form and sending it through the mail to the IRS.

Free-File Platform

The IRS offers the option of completing your tax returns online at no additional charge. You just have to enter this page and select the provider of your preference and the one that suits your specific case.

In addition, on that page, you will find instructions and additional information on how the platform works to complete the online forms.

On IRS Form 4868, page 4 you will find the addresses to which you will need to send the form once completed. However, for your convenience, you can check the following image and verify the corresponding addresses according to where you live or the return you want to extend.