If you ever lose your job for any reason other than your own, do not worry! You can easily apply to receive unemployment benefits while you look for another one. It is a state-federal program that provides temporary assistance (in form of weekly payments) to help individuals that were not prepared for this situation.

To be able to receive these benefits you must meet specific eligibility criteria, give proof of your current unemployment status, among other requirements.

Although it is simple, you may have some questions during the process, which is why in this article we will answer the most frequent ones and explain the main concepts you need to know.

How do you know if you qualify for unemployment?

The first thing you should know is that qualifications and requirements are different from one state to another. In fact, the name can also vary; you may find some states that refer to this type of assistance as “Unemployment Insurance Program” or “Unemployment Compensation”.

However, there are certain elements they have in common:

Cause of unemployment

The main requirement is that you must have lost your job through no fault of your own; if you resign from your job, you cannot apply to get these benefits. Instead, these are the valid causes of unemployment:

- Personnel reduction in the company.

- If you were dismissed because you are not capable to perform the tasks required for the job position (for example: you had an accident and your mobility skills are not the same).

- If you present a justified resignation; this means that you had a well-founded reason such as labor exploitation, sexual harassment, unsafe or unsanitary work conditions, etc.

On the other hand, another invalid cause of unemployment is misconduct; if your employer demonstrates that you were fired under this situation, you will not be eligible.

Financial history

The institution in charge of the application process will study your financial history. In most cases, you will have to show your previous earnings on a “base period” of one year, and meet a minimum and maximum earning requirement.

The “base period” might be different in each state, but it is generally the first 4 quarters out of the last 5 calendar quarters before you filed your claim.

For example: If you filed your claim in April 2021, your “base period” will be from January 2020 to December 2020 (4 quarters).

DISCLAIMER: Remember that this calculation might change depending on where you live; for example, in Alaska, there are two types of base periods.

Search for work

On the other hand, the fact that you have lost your job does not mean that you can receive unemployment benefits and live from them.

You must start looking for a job immediately and be able to start if there is an opportunity that fits your skills.

Some states will require that you register on a job search website or program; if you do not do it, you will not be eligible.

Required information and documentation

- Personal information: full name, address, phone number, email, etc.

- Family information: dependents, names, Social Security numbers, birth dates, etc.

- Social Security Number, proof of citizenship, or legal authorization to work in the US.

- Your last employer’s information: name of the company, address, phone number, boss or supervisor’s name, email, etc.

- First and last date of work.

- Your last salary.

- Some states might ask about other previous employers or jobs.

- Your skills and abilities.

- Special health conditions (if any, provide medical records or other valid documents to support your case).

➡ READ ALSO: If you give two weeks’ notice does your employer have to pay you?

How do I apply for unemployment benefits?

You can apply by phone, online, or in person. However, be sure to look up the exact information based on where you live; click here to find your state’s program.

If your claim is accepted, you will receive a Determination Letter noticing the amount you will be receiving. Then, you will have to file weekly claims to receive your weekly benefits.

Remember that if you stop or do not fulfill any of the requirements, you will lose the benefits immediately.

Frequently asked questions (FAQ)

Who pays for unemployment benefits?

Also known as Unemployment Insurance Program (UI), these benefits are paid through taxes from employers, such as state taxes, and the Federal Unemployment Tax Act (FUTA).

How much are unemployment benefits?

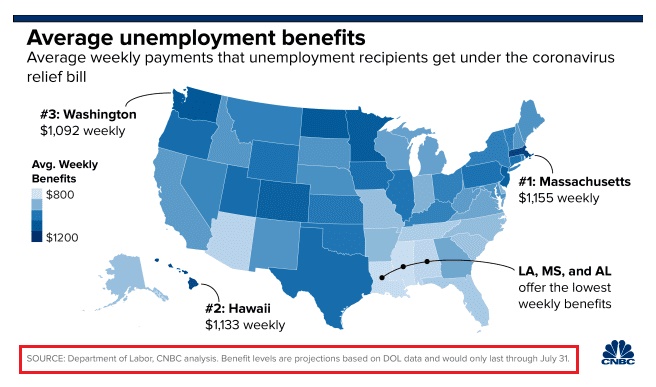

Sometimes people might say ‘I am unemployed and have collected unemployment’, but they do not know exactly how much they are receiving. According to a report made by CNBC, and data from the Department of Labor of the US, by the end of 2019, the average weekly amount for unemployment benefits was $378.

Can you collect benefits if you move out of state?

Yes. If you are moving and have already applied for unemployment benefits, you must notify the institution of both states that you wish to file an interstate unemployment claim and explain the reasons for your move.

However, remember that each state has its regulations, so you must check for both.

What Can I do when my unemployment benefits are expired or exhausted?

You can request Extended Benefits once your regular unemployment benefits are over. This will vary between states, however, most of them provide 13 weeks of Extended Benefits when is necessary.

This extension is mostly given when states are facing high periods of unemployment. However, if you qualify for regular benefits, that does not mean that you automatically qualify for Extended Benefits; the requirements are different.

What will disqualify you from unemployment benefits?

- Not meeting the required earning requirement.

- Resigning from your job without a valid and well-founded reason.

- Getting fired, especially for misconduct.

- Not looking for a job nor accepting a good offer.

Can military spouses get unemployment benefits?

Yes. If the spouse loses his/her job due to a military transfer, a PCS move, or similar, he or she can apply to get unemployment benefits.

However, this option is not available in all states.

How long do you have to work to collect unemployment?

There is not a general rule regarding how long you must work, however, some states might set a time. For example, in New York, you must have worked at least 2 calendar quarters (6 months).

Most of the time, the state will require that you have earned a specific amount of money during your “base period,” regardless of whether it was in two or nine months.

Can I collect unemployment while waiting for a new job to start?

Yes. Until you start the new job, you are still considered “unemployed”, so you can still get some benefits.

However, you must always report in your weekly claim that you found a new job and that you will be receiving an “X” amount as salary. It will not affect your weekly benefits until you start.

How do I know if my unemployment was denied?

If your claim is denied, you will receive a notification by mail or email, depending on how you applied. On it, you will find specific information about your case and how to appeal if you do not agree with the decision.

Can you go to jail for collecting unemployment while working?

Yes. It is considered a crime to collect unemployment benefits if you already start a new job. You can go to jail, pay fines, receive withholdings, and other penalties.

Can I receive unemployment benefits if I am self-employed?

Generally, no. Self-employers such as freelancers, gig workers, sole proprietors, etc., are not eligible for unemployment benefits.

However, under certain circumstances, you might get an opportunity if you are in a severe situation. Check with your state program.

Employee Rights

[pt_view id=”d9362255fi”]

Unemployment

[pt_view id=”88e8d76deh”]

Benefits

[pt_view id=”c943d5codh”]