According to the Corporate Law, there are two types of entities when it comes to businesses: Corporations and Limited Liability Companies (LLC). The first decision you have to make before starting your own business is to decide which type fits your interests best.

Despite there are several differences between both, the main one is that Corporations are owned by “shareholders” who receive property fractions, and LLCs are owned by one or more individuals who receive “memberships.”

Like any other state in the U.S, Virginia has its own regulations. In this article, you will find what you need to start your LLC in this state.

LLC Requirements

You need to complete a few requirements to register your business and work optimally, such as:

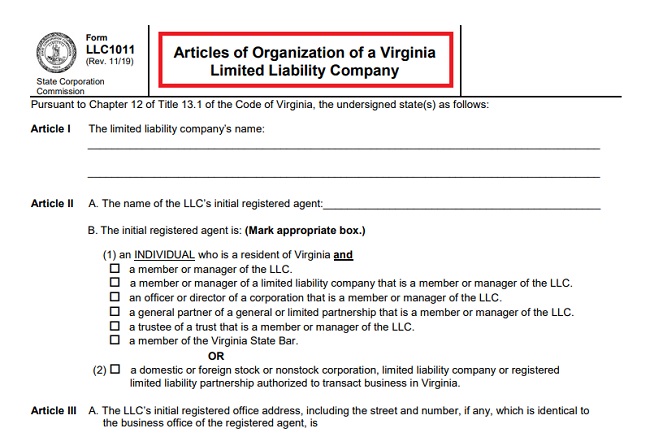

Articles of Organization

The first thing you need to do is writing the document that serves as your business’s initial statements, like each member’s duties, rights, liabilities, and powers. It is the legal document to form your company officially.

You can do it by completing the LLC1011 Form, in which you will specify the following things:

- Company name: The name must include the phrase Limited Liability Company or its abbreviation. Besides, you cannot choose a similar name to any other LLC in Virginia, because it may cause confusion; in other words, it must be distinguishable. Click here to verify that the name you want is not already registered.

- Registered agent: A registered agent is whether a person or a business entity that will be responsible for receiving your government correspondence, tax forms, and any other relevant legal document regarding your company. The person you appoint must be a resident of Virginia, or a business service authorized to operate in Virginia.

- Initial registered office and principal: This is your business address.

- LLC organizer: You also need to indicate an organizer. He will be the person who signs and submit your Articles of Organization. He can be someone of your trust and are not necessarily be a member or a manager.

On the other hand, you need to create an account in the Clerk’s Information System; click here to go to the portal.

LLC operating agreement

Although you are not mandated to write an operating agreement in Virginia, it may be beneficial for you to have one. This is a private document that contains ownerships conditions and operating procedures of your company.

It helps to prevent any business conflict, since it specifies all your financial and functional decisions.

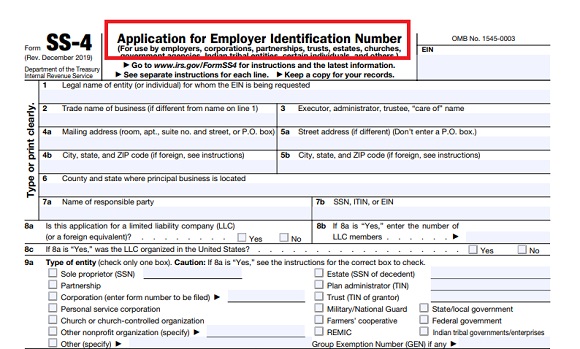

LLC EIN

This is the nine-digit Employer Identification Number (EIN) assigned by the Internal Revenue Service (IRS) to businesses for tax purposes. You will need it to pay Federal and State taxes, hire people, and even open a bank account.

The process to get an EIN is quite simple, and it is for free. There are two ways:

- Completing Form SS-4 and submitting it through fax (855) 641-6935 or mailing it to Internal Revenue Service. Attn: EIN Operation. Cincinnati, OH 45999.

- Calling 267-941-1099 (with additional costs).

- Trough the IRS official page.

Professional licensing and permits

LLCs in Virginia are not required to get a business license; instead, you will be asked to obtain professional licenses and permits for specific businesses. It will depend on your commercial activity.

Bank account

It is better to handle your finances if you have at least one bank account. You only need to submit in your local bank a copy of your Articles of Organization, the Operation Agreement, and the Virginia’s EIN.

How much does it cost to start an LLC in Virginia?

If you apply personally (by completing Form SS-4 and mailing it), you will need to pay $100 for The Commonwealth of Virginia’s filing; if you apply online, you will have to pay $3.

How long does it take to start an LLC in Virginia?

If you apply online, you may receive your registration certification the same day. However, if you print the form and mail it, your paperwork may take over 30 days to be processed.