A single-member LLC operating agreement is for the purpose, finances, and operations with an owner. This document supports create limited liability – the separation between the commercial and the owner’s individual or Personal property.

It may also be referred to as a sole-member LLC operating agreement. Since there is only one signatory, it has been recommended that the owners sign the operating agreement in the presence of the notary public to consider it time-stamped and legally valid.

What is a single-member LLC?

Also known as a sole-member LLC, is a limited liability company (LLC) with an owner (member). As a distinct entity, a single-member LLC protects its holder’s assets from the company’s debts and duties.

A single-member LLC benefits from a similar LLC tax classification as a multi-member LLC. According to the Internal Revenue Service (IRS), a single-member limited liability company is classified as a neglected entity, meaning it does not file tax returns on behalf of the business.

Profit and loss of business are recorded in the owner’s federal tax return. This earning is subject to self-employment taxes using Schedule C as a sole proprietorship.

Alternatively, a single-member LLC may elect to be taxed as a corporation by filing an entity classification election (Form 8832).

It is important to note that all states charge an annual fee for LLCs. For example, any LLC doing business or organized in California would have to pay $ 800 a year.

Should you create a single-member LLC operating agreement?

If you are forming an LLC on your own, you may think you do not need an operating agreement. However, it is highly recommended that you create one for the following reasons:

- Prove separation: An operating agreement serves as evidence for the courts that your single-member LLC is a separate entity from your assets. This is important if you or your LLC is suing based on your LLC business and trying to access your personal property.

- Define dissolution/succession: This allows you to explain how assets and liabilities should be distributed to the LLC in the event of a breach (although the liabilities are always paid first) and to someone in the event of your death or incapacity. Appoint to manage LLC in position.

- Set your own rules: Without an operating agreement, your single-member LLC is subject to the LLC rules in the state where the organization’s articles are filed.

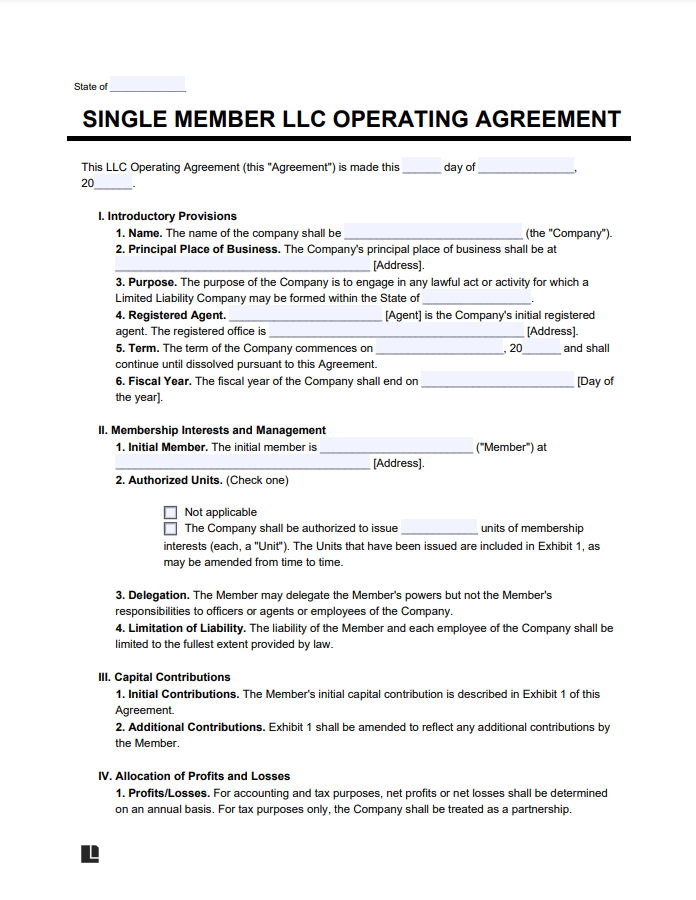

Tips to write a single-member LLC operating agreement

In general, the content should define the resolution, operations, and finances of your corporate. If you are serious about rising your single-member LLC, you must enter into a complete working agreement that includes:

- Company Description: It includes the company name & place.

- Registered Agent and Offices: Almost every state requires an LLC to appoint a registered agent and to list a registered office in the form written by the company. The registered agent must be available to accept government, legal and tax-related notifications on behalf of the business. Your operating agreement should include the name and contact details of the registered agent as well as the address of the registered office.

- Ownership: As a sole proprietor, declare that you are a limited liability company and 100% owner of the right to vote.Management: Specify whether your single-member LLC is member-managed or manager-managed. If you opt for a member-managed LLC, your operating agreement should state that you are the sole manager. If you choose a manager-managed structure, expand how many managers you intend to appoint, as well as their responsibilities and compensation.

- Adding new members: This gives you the option to add additional members to your LLC. Transitioning from a single-member LLC to a multi-member LLC will require significant changes to your operating agreement.

- Capital Contribution: An outline of capital contribution, including the cash, property.

- Payment: Clarify how you will be rewarded by the LLC, for example, by getting a regular pay or periodic lump-sum payment. Including this in your single-member LLC operating agreement indicates to the tax agencies that the business is a separate entity from you.

- Dissolution and Succession: Deliver a strategy for managing your corporate and resources if you die or become injured.

- Governing Law: Declare the state whose laws will govern this agreement and the company.

- Signature: you have to Sign the Single-member LLC operating agreement as a sole member. Since you are the only one signing the document, it is recommended that you sign it in the presence of a notary public.

It can be challenging to understand what an operating agreement for a single-member LLC should include. For your convenience, here is a template of a single-member LLC operating agreement where you can download it here.

Credit: this template is designed by legaltemplates.net/