When we are going to hire medical services, insurances, cable, memberships, or any type of service in which we have to pay to enjoy what we are requesting, it is recommended to search reviews from people who have already used them. In the case of our health, in addition to money (which is indeed important), we always tend to look for reviews since our life and health are involved in the subject. Medicare Advantage plans are one of the health care services with the most controversy around the quality of what they offer.

Surely you have heard or read that their plans are not as good as they appear to be, but is this really true? Or maybe we should be attentive and aware of what they really offer before joining?

Don’t go before reading the information we’ve collected for you.

What are Medicare Advantage Plans?

Medicare Advantage Plans are part of the health care services provided by Medicare, they are also known as “MA Plans” or “Part C” since they are a good option to get Part A and Part B of Original Medicare Coverage.

These plans are almost all offered by private companies that work with Medicare and, for the most part, their coverage includes obtaining drugs for patients. This coverage is known as “Part D”.

Medicare Advantage Plans are not free, you have to pay out-of-pocket a set limit each year to cover the health care services on your plan. Usually, it’s a low fee for patients who hire health care providers within the network of these plans.

On the other hand, you must be very careful with your Medicare Advantage card since you will need it to obtain the medical care you need depending on the plan you have hired. The most common are Special Needs Plan (SNP), Private Fee-for-Service (PFFS) Plans, Health Maintenance Organization (HMO), and Preferred Provider Organization (PPO).

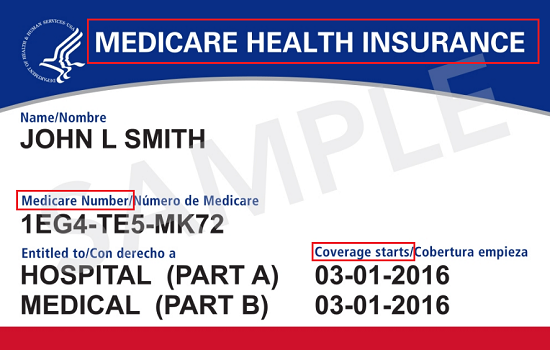

To obtain some of these plans you just have to indicate your Medicare Number, the date your Plan A or Plan B started (you can check this information on your Medicare card), and fill out a paper enrollment form. Besides, you can verify further information about Medicare Advantage Plans in your area here or by calling 1-800-633-4227.

Considerations before joining Medicare Advantage Plans

In the next few lines, we are going to clarify some key aspects about Medicare Advantage Plans with which many people are confused and it will be up to you if you decide to join this Medicare program.

-

Medicare Advantage Plans are not free

Many people tend to think that health care in these plans is free and confusion is created regarding copayments and coinsurance.

The reality is that Medicare Advantage Plans have a cost-sharing system that has the same system as Original Medicare with the difference that there are established limits for your out-of-pocket costs. If you join those plans, you have to pay approximately 20% of all covered services and Medicare for the remaining 80%.

Consequently, you will receive health coverage for a low cost but not for free. It is a great advantage for people suffering from illnesses since it helps them meet their medical needs without having to pay exorbitant bills.

READ MORE: Best-Rated Medicare Part D Plans

-

You will have to make multiple copayments for the same issue

With Original Medicare, the same situation happens but there is a marked difference between the two plans that you should know before deciding on which coverage best suits your needs.

Medicare Advantage Plan has a pay-as-you-go system, this means that even if you pay a monthly Part B premium and an additional premium for the plan when you use health care services, that is when you must pay copayments. For instance: if you go to a doctor’s visit, you must pay the copayment. The same happens when you need laboratory tests or your doctor refers you to a specialist, when you use these services is when you must pay copayments.

On the other hand, with Original Medicare, you pay next to nothing when you use health care services because, with your annual Part B, your coverage is almost completely paid.

You must understand this difference to make the best decision. Depending on your finances and your health condition, you should evaluate between these two options.

-

Medicare Advantage plans, providers, and costs change every year

Providers of this type of Medicare program may change their benefits plans and costs every year under the regulations of the Centers for Medicare and Medicaid Services (CMS).

That’s why people who join Medicare Advantage Plans should compare the programs every time they change the plans. Some enrollees aren’t aware of this and may choose a plan that doesn’t fit their needs.

-

Patients may be treated by nurse practitioners instead of doctors

By joining Medicare Advantage Plans we cannot affirm with certainty that every time you attend a medical consultation you will be treated by nurse practitioners. However, in many cases, it is this way.

This is because almost all plans offered by Medicare Advantage use a method of payment called capitation. Through this method, providers are paid a flat fee for each patient belonging to health coverage and due to a large number of enrolled patients every year, they intend to reduce the costs to attend the most patients as possible.

By reducing costs, a large number of primary group practices are performed by nurse practitioners but always supervised by a doctor.

-

Medicare Advantage Plans out-of-Pocket limits

In 2020, the out-of-pocket limit for in-network health care was approximately $ 4,900 and for the Preferred Provider Organization Program (PPO) the limit was approximately $ 8,200. This means that the disbursement limits are high and for this year they are expected to increase from $ 6,700 to $ 7,500, according to the new limit established by CMS.

Original Medicare may have high out-of-pocket limits but they are not as high as Medicare Advantage Plans limits.

These are some of the most common questions related to Medicare Advantage Plans and many times the regulations around the operation of this program are not as beneficial for some people as they can be for others. So we cannot say if the services offered by this type of Medicare program are either good or bad, you just have to carefully review each of the conditions to enroll in and determine if it is beneficial for you or not.