When a citizen of the state of Oklahoma loses his job, he can apply to obtain “unemployment benefits” if he meets the requirements for this purpose. These are contributions from the state to individuals who are not currently working for reasons beyond them.

States that provide these benefits have similar formats regarding payment amounts, qualification procedures, among other characteristics.

However, in this article, we will show you how these benefits work and what are the requirements to get them in Oklahoma.

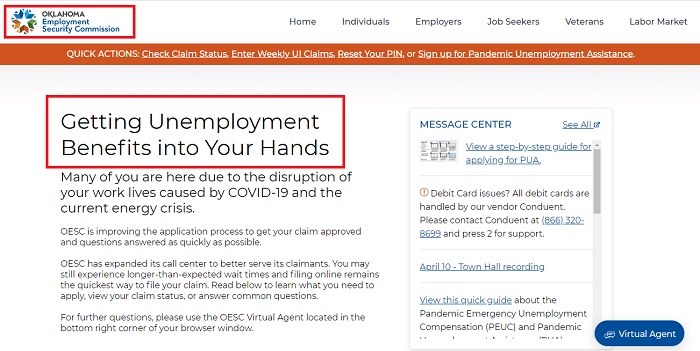

Oklahoma Employment Security Commission

The first thing to take into account is: What is the entity in charge of organizing and regulating these benefits? In Oklahoma, the department in charge of managing unemployment benefit applications is the Oklahoma Employment Security Commission (OESC).

Its primary mission is to systematize human capital in a labor scheme that meets the employment needs of Oklahomans and collaborate with employers to achieve better economic performance.

Request for unemployment benefits

Every citizen of Oklahoma has the right to apply for unemployment benefits. You can apply online, through the OESC website: ui.ok.gov/ssauth/register. Just log in with your user information, or create an account if you are not registered.

Once the OESC receives and reviews your application, you will receive a financial determination form, in which you must detail the amount of your past wages.

Oklahoma unemployment eligibility

Unemployment benefits are granted under a very measured control; The OESC carefully analyzes the eligibility of each applicant. Among the requirements to qualify, three of them stand out:

Previous payments

It is necessary to have received several salary payments before becoming unemployed; that is, you must have had a stable employment relationship previously.

The state of Oklahoma will study your work history, including your earnings. This study will be done for a base period of one year, starting on the first of the five quarters previous to your application.

For example: If you filed your claim in July 2019, the base period would start from February 1, 2018, until the last day of January 2019. During the entire base period, you should have perceived a minimum of $1,500.

Cause of unemployment

The cause of your unemployment cannot be -in any case- your own will. If it was your decision, you will not be eligible for this benefit.

Below, we will show some unemployment reasons that are considered valid:

- Dismissal due to the necessary reduction of personnel in the company you worked. Companies often fire employees when they can not cover their payrolls; if this is the case, you may qualify.

- Dismissal due to the inability to perform the skills assigned to do your work. You can not qualify for this if your dismissal is related to aggressive or disrespectful conduct. The state of Oklahoma considers “misconduct” as a risk to the safety of other employees, and therefore, the labor system.

- Justified resignation. A resignation is a voluntary way to stop working; therefore, you would normally disqualify for the benefits. However, if your resignation is well justified, you can still apply.

The reason for your resignation must demonstrate that there was no option but to leave the job. Many of these reasons include: working under unsafe conditions, sexual harassment, and your employer not paying your wages. Some personal reasons will also allow you to be eligible, for example, a medical condition or the need to provide care to a family member.

Willingness to work again

You must be able to work again at any time, and stay active looking for a new job.

These benefits are temporary; the state expects you to get a job as soon as possible and that in the meantime, you are not in precariousness. Also, if you get a job offer, you must accept it.

You should try to find a job at least twice a week.

The OESC will constantly ask beneficiaries for information about their job searches, the companies they have visited, the names of employers, etc., in order to verify that they are active and looking for a job in good faith.

Amount and duration of the benefits

Once you complete this procedure and meet the requirements, you will be able to obtain the benefits.

The weekly payment will be 1/23 of your highest salary during the base period you filed with the OESC.

The minimum amount you can receive each week is $16, and the maximum amount is $520; these earnings can be received for a maximum of 26 weeks. In exceptional cases, additional weeks can be covered.