Welcome to Unemployment

Your Guide to Successfully Navigating Unemployment

-

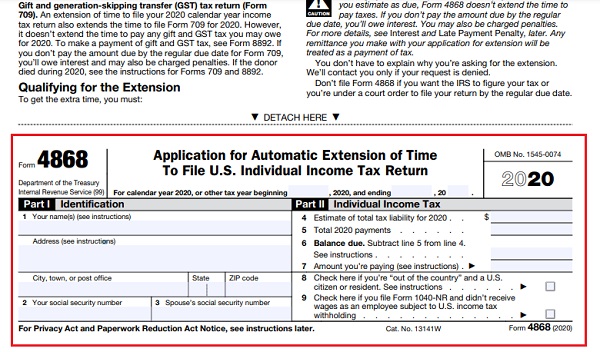

How to fill out IRS form 4868

As you should know, under normal conditions we must pay and file our tax returns between January 1st and April 15th, nevertheless, the Internal Revenue Service (IRS) has extended this deadline until May 17th, 2021. However, if we are not able to complete all the forms and submit all the paperwork by that date, the…

-

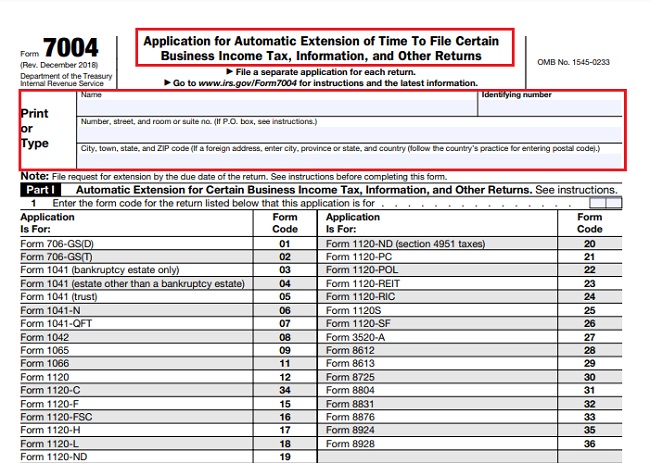

What is Form 7004 instructions – How to file

By the time we have to pay taxes and send the corresponding forms to the tax authorities, besides the requirements and the money we must pay, it is also very important to know the due dates; this will help us to avoid penalties for not delivering the paperwork on time. So, we must be very…

-

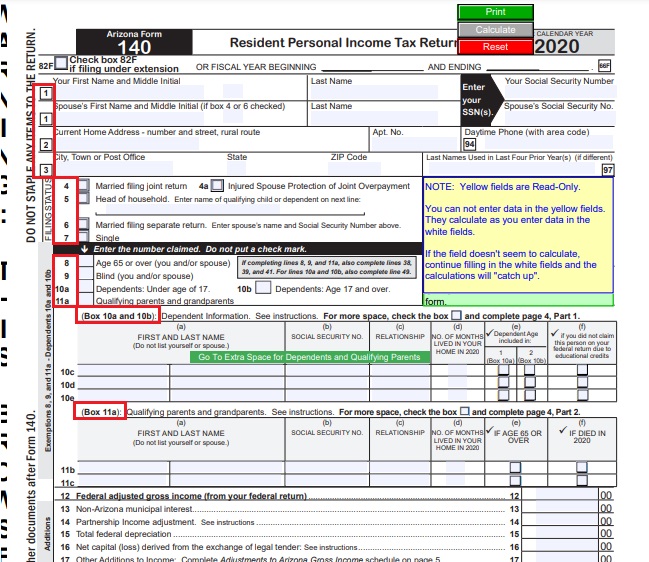

Instructions and Download of Arizona Form 140

When the time to pay taxes comes, we use to think of it as a cumbersome process due to all the calculations and forms that we must carefully fill out and sign. And perhaps it may not be so easy to complete this process but we should not underestimate ourselves and think that it is…

-

Is there an Inheritance Tax in Texas?

You may not have acres of estate, but there would be some property that you would leave to your family as an inheritance. While living in Texas, you must be worried and confused about your loved ones paying an inheritance tax. Most people are uninformed of the matters related to estate planning and taxes applicable, and…

-

IRS Schedule K-1 (Form 1065)

Being a part of a business partnership, you should know what tax requirements are imposed on you? You might think of partnership tax requirements the same as for sole proprietorships and corporations, but they are different. In the United States, certain entities are allowed for pass-through taxation. Due to this, these entities aren’t subjected to…

-

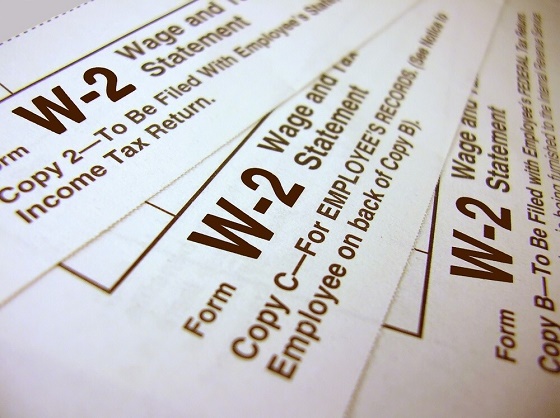

How to Get a W-2 Copy from 2015

Sometimes there can arise a situation when you suddenly need a copy of your W-2 form; maybe because you are expecting payback from past taxes, facing an audit, or a mortgage company is demanding it for your new house. Apart from that, you may be asked to provide your income proofs to inquire about your tax…

-

How to Get a Copy of My Paid Form 2290 Schedule 1?

Heavy Vehicle Use Tax (HVUT) is a tax that you pay to the federal Internal Revenue Service (IRS) for annual national highway use. It applies to the vehicles operating on public highways at a gross weight of 50,000 pounds. If you plan to pay your HVUT, you must be curious to know how it works. The…

-

How to Change an Address on a Driver’s License in Wisconsin?

Are you moving somewhere within Wisconsin? Before moving, you will have many things on your moving-to-do list, and one of them should be to change the address on your driver’s license. Of course, you never want to move your car with fear and stress. Most states provide less than 30 days limit to update the…